A leading manufacturer of specialized, critical, and recurring consumable products Tega Industries raised ₹186 crores from anchor investors on November 30, 2021 Tuesday before the IPO. The Tega Industries IPO to open on December 01, Wednesday. The company allotted total of 41,00,842 equity shares to 25 Anchor investors at a upper price band ₹453. The anchor investors list includes 8 Mutual Funds through a total of 19 schemes. The company is going to raise ₹619 crores via IPO (OFS). Check out the final list of Tega Industries Anchor Investors given below:

Tega Industries Anchor Investors List:

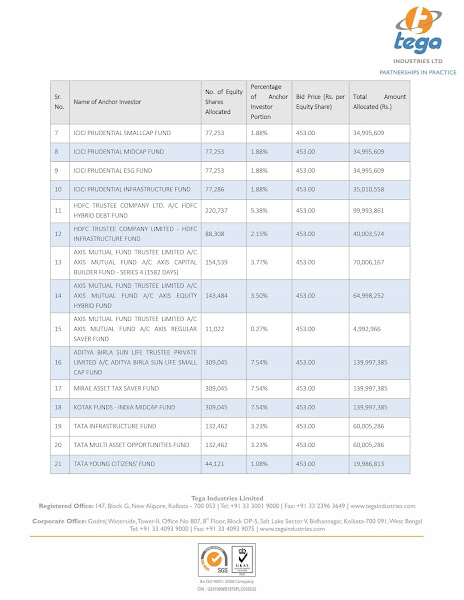

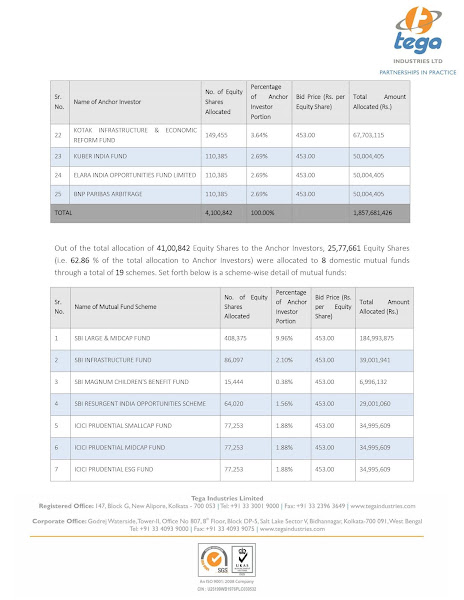

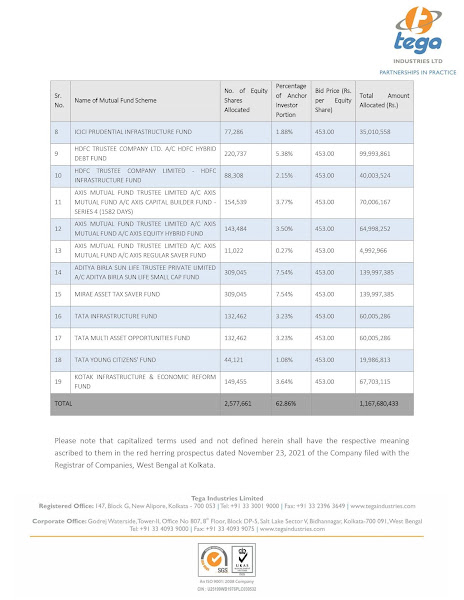

The IPO Committee of the Company in their meeting held on November 30, 2021, in consultation with Axis Capital Limited and JM Financial Limited (collectively, the “Book Running Lead Managers”), have finalized allocation of 41,00,842 Equity Shares to Anchor Investors at Anchor Investor Allocation Price of Rs. 453 per Equity Share (including a share premium of Rs.443 per Equity Share) in the following manner. The details are given below:

Source: BSEIndia

The Tega Industries IPO to open on 01 December and closes on 03 November 2021. The price band is fixed at ₹443 to ₹453. Tega Industries IPO application minimum bid is for 33 Shares (₹14,949) and maximum bid is 429 shares (₹194,337). The Book Running Lead Managers of the IPO are Axis Capital Limited and JM Financial Consultants Private Limited.