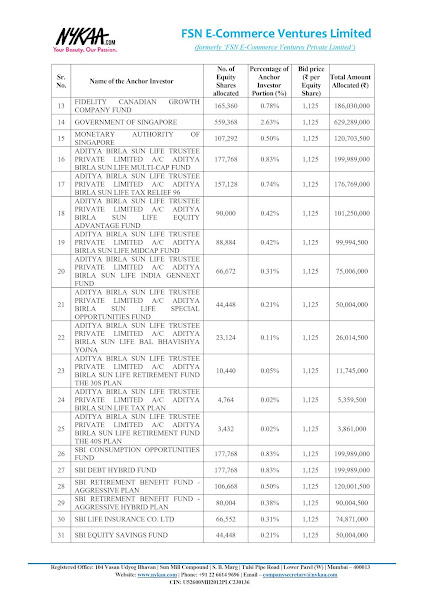

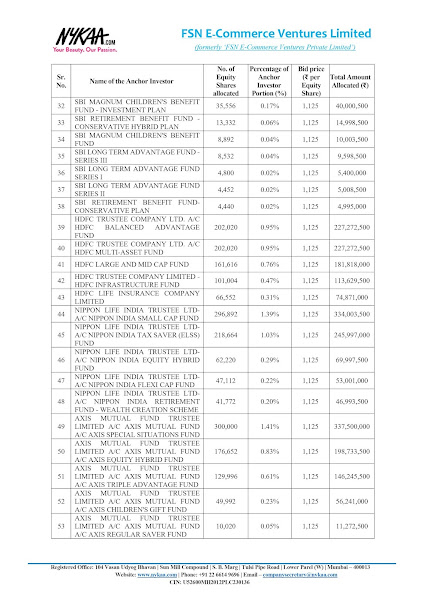

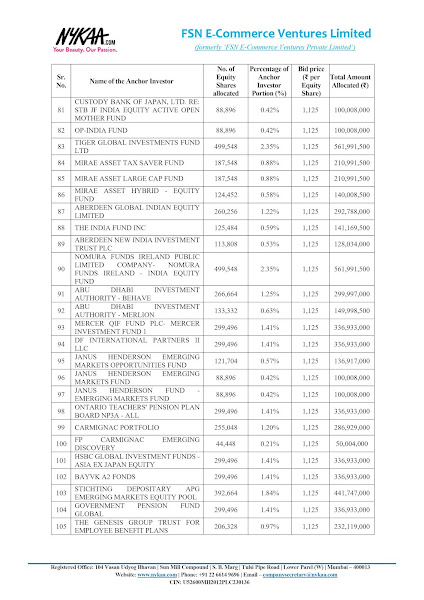

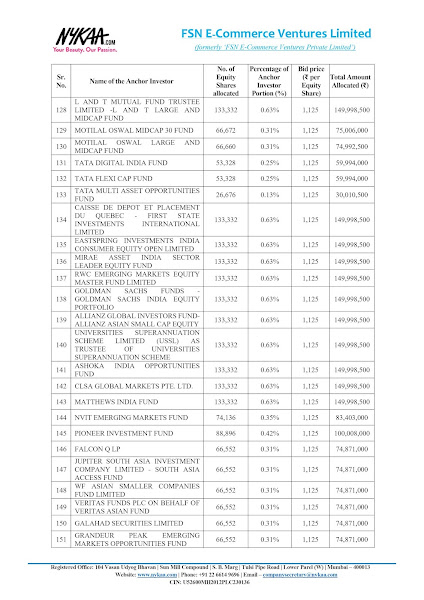

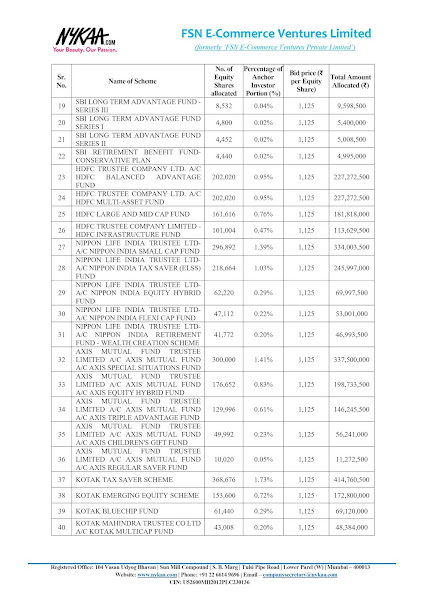

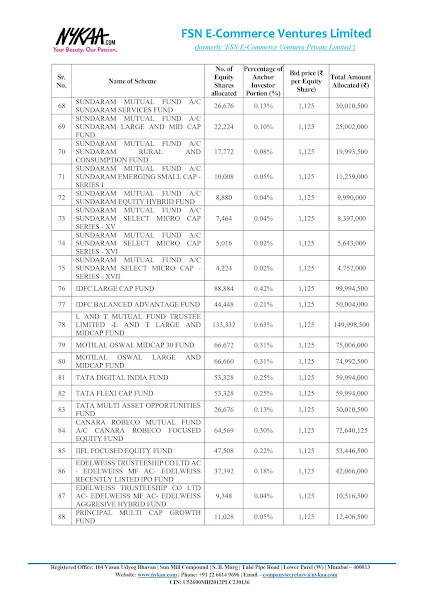

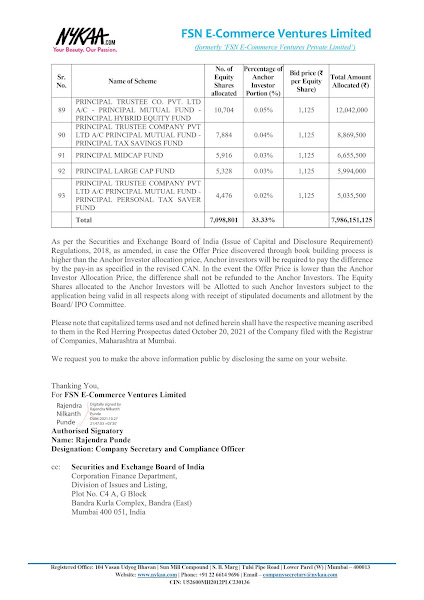

A Maharashtra based beauty, wellness and fashion products seller FSN E-Commerce Ventures Private Limited aka Nykaa raised ₹2,396 crores from anchor investors on October 27, 2021 Wednesday before the IPO. The Nykaa IPO to open on Thursday, October 28. The company allotted total of 21,296,397 equity shares to 174 anchor investors at a upper price band ₹1,125. The anchor investors list includes 21 Mutual Funds through a total of 93 schemes. The company is going to raise ₹5352 crores via IPO. Check out the final list of Nykaa Anchor Investors given below:

List of Nykaa Anchor Investors:

The IPO Committee of the Board of the Directors of the Company vide resolution on October 27, 2021, in consultation with Kotak Mahindra Capital Company Limited and Morgan Stanley India Company Private Limited (“Global Coordinators and Book Running Lead Managers” or the “GCBRLMs”), and BofA Securities India Limited, Citigroup Global Markets India Private Limited, ICICI Securities Limited and JM Financial Limited (“Book Running Lead Managers” for the offer or the “BRLMs” and together with the GCBRLMs the “Lead Managers”), has finalized allocation of 21,296,397 Equity Shares in aggregate, to Anchor Investors at the Anchor Investor Allocation Price of ₹ 1,125 per Equity Share (including share premium of ₹ 1,124 per Equity Share). The details are given below: