Popular Vehicles & Services is a leading diversified automobile dealership in India in terms of revenue as of Fiscal 2023, (Source: CRISIL Report) having a fully integrated business model. They cater to the complete life cycle of vehicle ownership, right from the sale of new vehicles, servicing and repairing vehicles, and distributing spare parts and accessories, to facilitating the sale and exchange of preowned vehicles, operating driving schools, and facilitating the sale of third-party financial and insurance products. they categorize their automobile dealership business into three key segments, namely, (a) passenger vehicles including luxury vehicles, (b) commercial vehicles, and (c) electric two-wheeler and three-wheeler vehicles, which contributed to their revenue from operations aggregating ₹30,143.51 million, ₹15,702.54 million and ₹559.05 million, respectively, in Fiscal 2023.

They operate (a) passenger vehicle dealerships covering economy, premium and luxury vehicles across their dealerships for the following OEMs: (i) Maruti Suzuki India Limited (“Maruti Suzuki”) for both Arena and Nexa, through the Company, (ii) Honda Cars India Limited (“Honda”) through their Subsidiary, VMPL, and (iii) Jaguar Land Rover India Limited (“JLR”) through their Subsidiary, PAWL; (b) commercial vehicle dealerships of (i) Tata Motors Limited (“Tata Motors (Commercial)”), through their Subsidiary, PMMIL and (ii) Daimler India Commercial Vehicles Private Limited (“BharatBenz”), through their Subsidiary, PMPL; and (c) electric three-wheeler vehicle dealership of Piaggio Vehicles Private Limited, including commercial and cargo vehicles (“Piaggio”), through their Subsidiary, KGPL and electric two-wheeler vehicle dealership of Ather Energy Private Limited (“Ather”), through their Subsidiary, KCPL. Their presence across vehicle categories, including passenger vehicles, commercial vehicles, and electric two-wheeler and three-wheeler vehicles, further diversifies their revenue streams.

Popular Vehicles acquired 11 service centers and 2 showrooms from a dealer of Maruti Suzuki in Kerala in 2021. Further, they acquired 8 showrooms, 17 service centers, and 3 sales outlets and booking offices of BharatBenz in Tamil Nadu and Maharashtra. They have also expanded their post-sale services and repair verticals in the last three Fiscals. Their revenue from servicing passenger vehicles and commercial vehicles has seen a significant increase, from ₹3,651.64 million and ₹675.06 million in Fiscal 2021 to ₹5,716.13 million and ₹1,418.65 million in Fiscal 2023, respectively. In Fiscal 2023, they were ranked ‘All India Highest in the Bodyshop Load’ for Maruti Suzuki. Further, the number of electric two-wheeler and three-wheeler vehicles sold by us has also increased from 252 in Fiscal 2022 to 3,381 in Fiscal 2023.

Objects of the Issue

- Repayment and/or pre-payment, in full or part, of certain borrowings, availed by the company and certain of the subsidiaries, namely, VMPL, PAWL, PMMIL, KGPL, KCPL and PMPL.

- IGeneral corporate purposes.

Popular Vehicles & Services IPO Review (Apply or Not)

- Apply with Longterm View

Brokerage Firm IPO Review

- Capital Market: NA

- Religare Broking: NA

- Hem Securities: NA

- Arihant Capital: NA

Popular Vehicles & Services IPO Date & Price Band Details

| IPO Open: | March 12, 2024 |

| IPO Close: | March 14, 2024 |

| IPO Size: | Approx ₹601.55 Crores |

| Fresh Issue: | Approx ₹250 Crores |

| Offer for Sale: | Approx 11,917,075 Equity Shares |

| Face Value: | ₹2 Per Equity Share |

| IPO Price Band: | ₹280 to ₹295 Per Share |

| IPO Listing on: | BSE & NSE |

| Retail Quota: | 35% |

| QIB Quota: | 50% |

| NII Quota: | 15% |

| Discount: | N/A |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors List: | Click Here |

Popular Vehicles & Services IPO Market Lot

The Popular Vehicles & Services IPO minimum market lot is 50 shares with ₹14,750 application amount. The retail investors can apply up-to 13 lots with 650 shares or ₹191,750 amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 50 | ₹14,750 |

| Retail Maximum | 13 | 650 | ₹191,750 |

| S-HNI Minimum | 14 | 700 | ₹206,500 |

| B-HNI Minimum | 68 | 3400 | ₹1,003,000 |

Popular Vehicles & Services IPO Allotment & Listing Dates

The Popular Vehicles & Services IPO date is March 12 and the close date is March 14. The Popular Vehicles & Services IPO allotment will be finalized on March 15 and the IPO listing on March 19.

| Anchor Investors Allotment: | March 11, 2024 |

| IPO Open Date: | March 12, 2024 |

| IPO Close Date: | March 14, 2024 |

| Basis of Allotment: | March 15, 2024 |

| Refunds: | March 18, 2024 |

| Credit to Demat Account: | March 18, 2024 |

| IPO Listing Date: | March 19, 2024 |

You can check IPO subscription status and IPO allotment status on their respective pages.

Popular Vehicles & Services IPO Form

How to apply for the Popular Vehicles & Services IPO? You can apply for Popular Vehicles & Services IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Popular Vehicles & Services IPO in the Invest section. The other option is you can apply for Popular Vehicles & Services IPO via IPO forms downloaded via NSE and BSE. Check out the Popular Vehicles & Services forms – Click BSE Forms & NSE Forms blank IPO forms download, fill, and submit in your bank or with your broker.

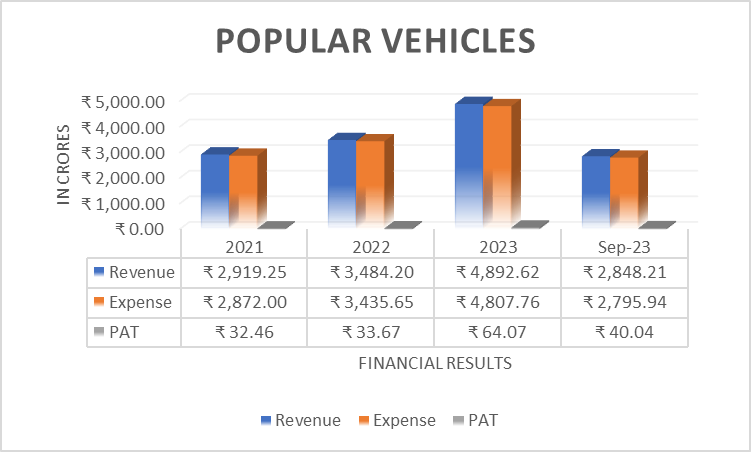

Popular Vehicles & Services Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2021 | ₹2919.25 | ₹2872.00 | ₹32.46 |

| 2022 | ₹3484.20 | ₹3435.65 | ₹33.67 |

| 2023 | ₹4892.62 | ₹4807.76 | ₹64.07 |

| Sep 2023 | ₹2848.21 | ₹2795.94 | ₹40.04 |

Popular Vehicles & Services IPO Valuation – FY2023

Check Popular Vehicles & Services IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| Earning Per Share (EPS): | ₹10.22 per Equity Share |

| Price/Earning P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 18.68% |

| Net Asset Value (NAV): | ₹54.69 per Equity Share |

Peer Group

- Landmark Cars Limited

Company Promoters

- John K. Paul

- Francis K. Paul

- Naveen Philip

Popular Vehicles & Services IPO Registrar

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: Signatureglobal.ipo@linkintime.co.in

Website: https://linkintime.co.in/

Popular Vehicles & Services IPO Allotment Status Check

Check Popular Vehicles & Services IPO allotment status on Linkintime website allotment URL. Click Here

Popular Vehicles & Services IPO Lead Managers aka Merchant Bankers

- ICICI Securities Limited

- Nuvama Wealth Management Limited

- Centrum Capital Limited

Company Address

Popular Vehicles & Services Limited

Kuttukaran Centre

Mamangalam, Cochin

Ernakulam 682 025

Phone: +91 484 2341 134

Email: cs@popularv.com

Website: https://www.popularmaruti.com/

Popular Vehicles & Services IPO FAQs

What is Popular Vehicles & Services IPO?

When Popular Vehicles & Services IPO will open?

What is Popular Vehicles & Services IPO Investors Portion?

How to Apply the Popular Vehicles & Services IPO?

How to Apply the Popular Vehicles & Services IPO through Zerodha?

How to Apply the Popular Vehicles & Services IPO through Upstox?

How to Apply the Popular Vehicles & Services IPO through Paytm Money?

What is Popular Vehicles & Services IPO Size?

What is Popular Vehicles & Services IPO Price Band?

What is the Popular Vehicles & Services IPO Allotment Date?

What is the Popular Vehicles & Services IPO Listing Date?

Note: The Popular Vehicles & Services IPO price band and date are officially announced. The IPO grey market premium (Popular Vehicles & Services IPO Premium) will be added to the IPO grey market page as it will start).