Krystal Integrated is one of India’s leading integrated facilities management services companies, with a focus on healthcare, education, public administration (state government entities, municipal bodies, and other government offices), airports, railways and metro infrastructure, and retail sectors (Source: F&S Report). They provide a comprehensive range of integrated facility management service offerings across multiple sectors and consequently are among select companies in India that have a wide geographic presence and customer base, catering to almost all end-user segments, as of March 31, 2023. (Source: F&S Report).

Their range of service offerings includes soft services such as housekeeping, sanitation, landscaping, and gardening, hard services such as mechanical, electrical, and plumbing services, solid, liquid, and biomedical waste management, pest control and façade cleaning and other services such as production support, warehouse management and airport management services (including multi-level parking and airport traffic management). They also provide staffing solutions and payroll management to their customers, as well as private security and manned guarding services and catering services.

They have also built expertise in catering to the healthcare, education, airport, railways, and metro infrastructure sectors, due to their extensive experience, and understanding the unique requirements and challenges in such sectors. As of March 31, 2023, they provided their services to 134 hospitals and medical colleges, 224 schools and colleges (other than medical colleges), two airports, four railway stations, and 10 metro stations, along with catering services on certain trains/ train routes.

Objects of the Issue

- Repayment/prepayment, in full or part, of certain borrowings availed of by our Company

- Funding working capital requirements of our Company

- Funding capital expenditure for purchase of new machinery

- General corporate purposes

Krystal Integrated IPO Review (Apply or Not)

- Apply with Long term views

Brokerage Firm IPO Review

- Capital Market: May Apply

- Swastika Investmart Ltd – Neutral

Krystal Integrated IPO Date & Price Band Details

| IPO Open: | March 14, 2024 |

| IPO Close: | March 18, 2024 |

| IPO Size: | Approx ₹300.13 Crores |

| Fresh Issue: | Approx ₹175 Crores |

| Offer for Sale: | Approx 1,750,000 equity shares |

| Face Value: | ₹10 Per Equity Share |

| IPO Price Band: | ₹680 to ₹715 Per Share |

| IPO Listing on: | BSE & NSE |

| Retail Quota: | 35% |

| QIB Quota: | 50% |

| NII Quota: | 15% |

| Discount: | N/A |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors List: | Click Here |

Krystal Integrated IPO Market Lot

The Krystal Integrated IPO minimum market lot is 20 shares with ₹14,300 application amount. The retail investors can apply up-to 13 lots with 260 shares or ₹185,900 amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 20 | ₹14,300 |

| Retail Maximum | 13 | 260 | ₹185,900 |

| S-HNI Minimum | 14 | 280 | ₹200,200 |

| B-HNI Minimum | 70 | 1,400 | ₹1,001,000 |

Krystal Integrated IPO Allotment & Listing Dates

The Krystal Integrated IPO date is March 14 and the close date is March 18. The Krystal Integrated IPO allotment will be finalized on March 19 and the IPO listing on March 21.

| Price Band Announcement: | March 13, 2024 |

| IPO Open Date: | March 14, 2024 |

| IPO Close Date: | March 18, 2024 |

| Basis of Allotment: | March 19, 2024 |

| Refunds: | March 20, 2024 |

| Credit to Demat Account: | March 20, 2024 |

| IPO Listing Date: | March 21, 2024 |

You can check IPO subscription status and IPO allotment status on their respective pages.

Krystal Integrated IPO Form

How to apply for the Krystal Integrated IPO? You can apply for Krystal Integrated IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Krystal Integrated IPO in the Invest section. The other option is you can apply for Krystal Integrated IPO via IPO forms downloaded via NSE and BSE. Check out the Krystal Integrated forms – Click BSE Forms & NSE Forms blank IPO forms download, fill, and submit in your bank or with your broker.

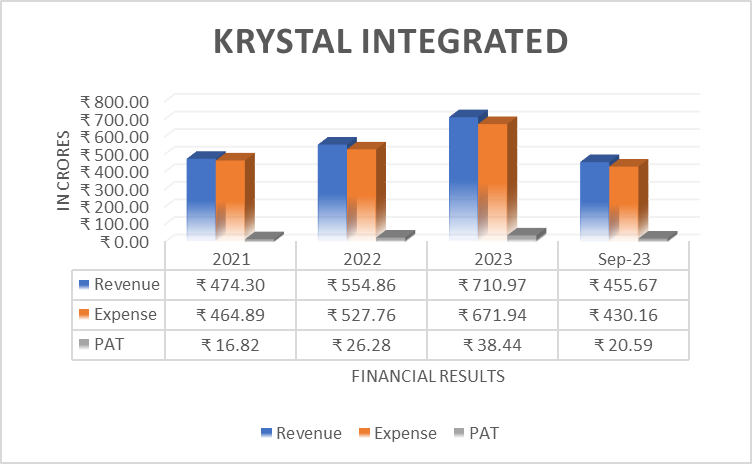

Krystal Integrated Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2021 | ₹474.30 | ₹464.89 | ₹16.82 |

| 2022 | ₹554.86 | ₹527.76 | ₹26.28 |

| 2023 | ₹710.97 | ₹671.94 | ₹38.44 |

| Sep 2023 | ₹455.67 | ₹430.16 | ₹20.59 |

Krystal Integrated IPO Valuation – FY2023

Check Krystal Integrated IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| Earning Per Share (EPS): | ₹33.33 per Equity Share |

| Price/Earning P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 23.53% |

| Net Asset Value (NAV): | ₹236.15 per Equity Share |

Peer Group

- Quess Corp Limited

- SIS Limited

Company Promoters

- Prasad Minesh Lad

- Neeta Prasad Lad

- Saily Prasad Lad

- Shubham Prasad Lad

- Krystal Family Holdings Private Limited

Krystal Integrated IPO Registrar

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: [email protected]

Website: https://linkintime.co.in/

Krystal Integrated IPO Allotment Status Check

Check Krystal Integrated IPO allotment status on Linkintime website allotment URL. Click Here

Krystal Integrated IPO Lead Managers aka Merchant Bankers

- Inga Ventures Private Limited

Company Address

Krystal Integrated Services Ltd

Krystal House 15A 17

Shivaji Fort CHS, Duncans Causeway

Road, Mumbai –400022,

Phone: +912247471234

Email: [email protected]

Website: https://krystal-group.com/

Krystal Integrated IPO FAQs

What is Krystal Integrated IPO?

When Krystal Integrated IPO will open?

What is Krystal Integrated IPO Investors Portion?

How to Apply the Krystal Integrated IPO?

How to Apply the Krystal Integrated IPO through Zerodha?

How to Apply the Krystal Integrated IPO through Upstox?

How to Apply the Krystal Integrated IPO through Paytm Money?

What is Krystal Integrated IPO Size?

What is Krystal Integrated IPO Price Band?

What is the Krystal Integrated IPO Allotment Date?

What is the Krystal Integrated IPO Listing Date?

Note: The Krystal Integrated IPO price band and date are officially announced. The IPO grey market premium (Krystal Integrated IPO Premium) will be added to the IPO grey market page as it will start).