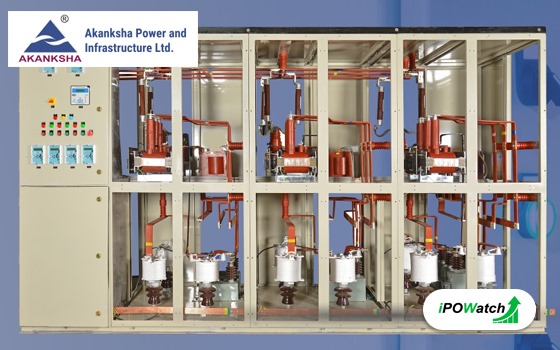

Akanksha Power and Infrastructure is engaged in the business of manufacturing electric equipment, including electrical panels, instrument transformers, and vacuum contactors, catering to consumers from institutions, industries, and electricity transmission and distribution utilities. The Company has two (2) manufacturing plants, to manufacture the products with emphasis on quality and performance.

The Company is an ISO 9001:2015 certified organization engaged in the business of Design, Manufacturing and Supply of CT-PT, Metering Units and Cubical, Automatic power correction panel (Capacitor Panel), fixed capacitor banks, Motor Control Centre (MCC), Power Control Centre (PCC), Variable Frequency Drive (VFD) Panels, Thyristor switches and Vacuum contactors, Energy Management System and Smart Energy Meters (Advanced Metering Infrastructure), in addition to engineering and execution of electrical turnkey projects.

In addition to production and manufacturing, they are also providing services related to the distribution and management of electricity our operation includes the establishment of electrical infrastructure which involves power quality audit, site analysis, online cloud-based multiple monitoring, and data analysis for better management to reduce losses in Transmission, Distribution and User level. They are also engaged in managing electrical distribution networks for the distribution companies (DISCOMs).

Objects of the Issue:

- To meet the Capital Expenditure Requirement of the Company.

- To meet the Working Capital requirements of the Company.

- To meet the General Corporate Purposes.

- To meet the Issue Expenses.

Akanksha Power and Infrastructure IPO Review

- May Apply

Akanksha Power IPO Date & Price Band Details

| IPO Open: | December 27, 2023 |

| IPO Close: | December 29, 2023 |

| IPO Size: | Approx ₹27.49 Crores, 4,998,000 Equity Shares |

| Face Value: | ₹10 Per Equity Share |

| IPO Price Band: | ₹52 to ₹55 Per Equity Share |

| IPO Listing on: | NSE SME |

| Retail Quota: | 35% of the net offer |

| QIB Quota: | 50% of the net offer |

| NII Quota: | 15% of the net offer |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors in IPO: | Click Here |

Akanksha Power IPO Market Lot

The Akanksha Power and Infrastructure IPO minimum market lot is 2000 shares with a ₹110,000 application amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 2000 | ₹110,000 |

| Retail Maximum | 1 | 2000 | ₹110,000 |

| S-HNI Minimum | 2 | 4000 | ₹220,000 |

Akanksha Power IPO Dates

The Akanksha Power and Infrastructure IPO date is December 27 and the IPO close date is December 29. The IPO allotment date is January 1 and the IPO might list on January 3.

| IPO Open Date: | December 27, 2023 |

| IPO Close Date: | December 29, 2023 |

| Basis of Allotment: | January 1, 2024 |

| Refunds: | January 2, 2024 |

| Credit to Demat Account: | January 2, 2024 |

| IPO Listing Date: | January 3, 2024 |

You can check IPO subscription status and IPO allotment status on their respective pages.

Akanksha Power IPO Form

How to apply Akanksha Power and Infrastructure IPO? You can apply Akanksha Power and Infrastructure IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Akanksha Power and Infrastructure IPO in the Invest section. The other option you can apply Akanksha Power and Infrastructure IPO via IPO forms download via the NSE website. Check out the Akanksha Power and Infrastructure forms – click NSE IPO Forms download, fill and submit in your bank or with your broker.

Akanksha Power Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2021 | ₹74.41 | ₹68.91 | ₹3.92 |

| 2022 | ₹52.07 | ₹48.62 | ₹2.41 |

| 2023 | ₹46.44 | ₹42.40 | ₹2.91 |

| 2024 3M | ₹10.27 | ₹9.32 | ₹0.71 |

Akanksha Power IPO Valuation – FY2023

Check Akanksha Power and Infrastructure IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| Earning Per Share (EPS): | ₹2.29 per Equity Share |

| Price/Earning P/E Ratio: | NA |

| Return on Net Worth (RoNW): | 18.20% |

| Net Asset Value (NAV): | ₹87.93 per Equity Share |

Peer Group

- HPL Electric & Power Limited

- Genus Power Infrastructure Limited

- Cospower Engineering Limited

Company Promoters

- Mr. Bipin Bihari Das Mohapatra

- Ms. Chaitali Bipin Dasmohapatra

Akanksha Power IPO Registrar

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: akanksha.ipo@linkintime.co.in

Website: https://linkintime.co.in/

Akanksha Power IPO Allotment Status

Check Akanksha Power and Infrastructure IPO allotment status on Link Intime website URL. Click Here

Akanksha Power IPO Lead Managers aka Merchant Bankers

- Narnolia Financial Services Ltd

Company Address

Akanksha Power and Infrastructure Limited

Plot No. 87/4

MIDC, Satpur,

Nashik- 422007,

Phone: +91 9370345000

Email: bdm@apil.co.in

Website: https://www.apil.co.in/

One Response

No, That is not true. It should be done on lottery basis.