According to the source, there will be a fresh issue and an offer-for-sale, and both will have shares of ₹2,000 crore each. External investors like Synergy Metals Investment Holding, Apollo Global Management, and State Bank of India (SBI) will be able to partially exit their investments through the Offer for Sale.

The source also said that SBI Capital, Jefferies, Kotak Mahindra Capital, JM Financial, Goldman Sachs, Citi, DAM Capital, and Axis Capital are the investment banks handling the share sale.

The money raised from the new issue will be used by JSW Cement to support its expansion goals. The aim of the company is to make it to one of the top five cement manufacturers in India by increasing its production capacity to 60 million tonnes per annum (mtpa) in the next five years. This is the cement industry’s first significant initial public offering (IPO) since August 2021’s ₹5,000 crore offering by Nuvoco Vistas.

JSW Cement plans to increase capacity at its Vijayanagar unit and subsidiary, Shiva Cement, as well as expand geographically into North India with new units in Punjab and Rajasthan. This location will help the company expand its presence in northern India. According to reports, JSW Cement plans to acquire a portion of Orient Cement. The company wants to reach a total capacity of 30.6 mtpa by FY27.

JSW Cement is a major player in the Indian cement industry, producing various grades of cement such as Concreel HD (CHD), Ordinary Portland Cement (OPC), Portland Slag Cement (PSC), Composite Cement (CPC) and Ground Granulated Blast Furnace Slag (GGBS). The company runs manufacturing facilities in West Bengal, Maharashtra, Karnataka, Odisha, and Andhra Pradesh. It is also a pioneer in the production of environmentally friendly building materials, such as India’s greenest ready-mix concrete (RMC) product, “GreenCrete,” which blends high durability with reduced carbon emissions.

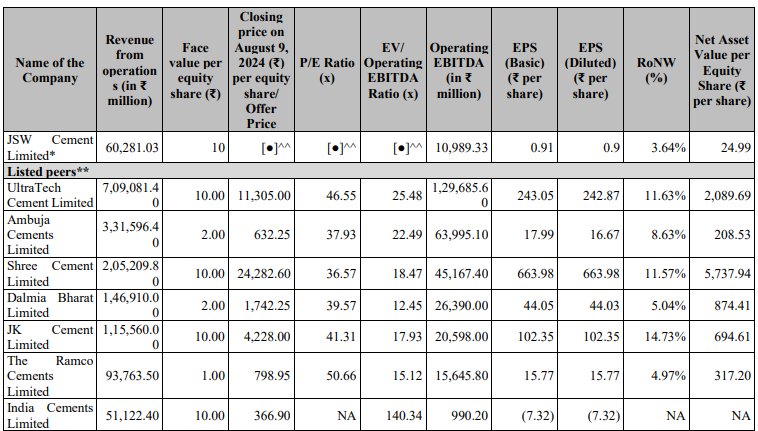

JSW Cement reported a profit of ₹59 crores and revenues of ₹5,845 crores for the fiscal year ending on March 31, 2024. The company operates in South India (11.0 mtpa), East India (5.1 mtpa), and West India (4.5 mtpa). As of March 2024, its production capacity was 20.6 mtpa.