✤ What is the IPO Price band?

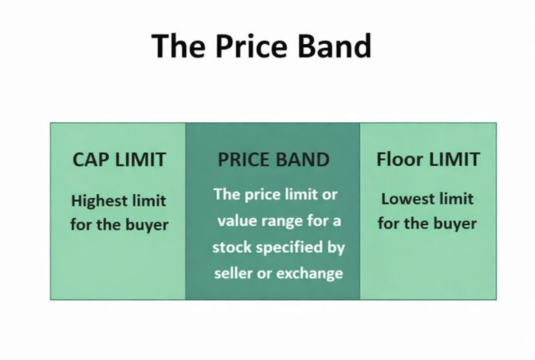

An IPO price band is the range of prices at which investors can apply to buy shares when a company goes public.

This band helps both the company and investors. The company can figure out the right price based on demand, and investors get the flexibility to decide how much they’re willing to pay.

✤ How is the Price band decided?

IPO price band selection is one of the important tasks in the IPO process. Choosing the perfect price band for bidding helps investors determine when and how much money they should invest.

The information below helps you to know how and why the IPO price decision is made.

✤ IPO launching firm:-

The IPO launching company is well-known for its company fundamentals and valuation, such as cash-flows, revenue, profit and loss, debt, liabilities, and many more things regarding the company.

Therefore, the firm can choose the price band range or a fixed price amount.

✤ Merchant bankers’ analysis:

Taking the IPO price band decision is not just a piece of cake, as it includes various analyses by investment bankers.

The lead manager’s research for revenue, profits, and growth rates, debt and cash flow position, and many more points.

Afterwards, they also considered Price-to-Earnings (P/E) ratio, EV/EBITDA ratio, etc. Not only peer group comparison, but they also take care of market scenarios.

Moreover, they also focus on the IPO price method, whether to go for bookbuilding or a fixed price.

Last, the firm and the Issue managers have a mutual discussion for the IPO price decision.

✤ Why does the Price band matter in an IPO?

In the IPO process, selecting the IPO Price band is essential as it provides an idea of what the company thinks the shares are worth and can help you start your research and analysis.

IPO price band selection is one of the important steps. It can help people determine what the company thinks the shares are worth. Due to the price band selection, investors could have an idea whether to invest in the firm or not.

✤ There are two types of IPO Price methods:-

| Book build Price | Fixed Price |

| SEBI introduced it in 1995 to make IPO pricing more fair and efficient. | It was the old, traditional way of issuing IPOs before the modern system. |

| If the price band has a range, it’s called the Bookbuilding Price IPO. | If the price band is fixed with one amount instead of ranging, it is called a Fixed price IPO. |

| It means that the company looks at how many investors are willing to buy the shares at different prices, and then chooses the final price based on where the demand is highest. | The price has already been decided before subscription, and investors have to bid on that single price. |

| The actual price is decided by the real investors. | The company is only for the price decision, and price can sometimes be overvalued and undervalued. |

| In a Book-built IPO, the demand for shares is tracked every day. | In a Fixed-price IPO, the total demand for shares is only known after the IPO ends. |

✤ What are the IPO Price band rules?

IPO price band rules are given below the line.

- The IPO prospectus must clearly state the basis of price determination.

- In the IPO price band, the floor price and upper price deterrent should be more than 20%.

- In the SME IPO, investors have to apply at a specific price within the range, which indicates that capital providers are willingly paying the IPO price band.

- While in the Mainboard IPO, retailers have two options: whether to go with the selected price or the cut-off price.

Frequently Asked Questions

The price band is the price range (minimum and maximum) at which investors can apply for shares in an IPO.

The company, along with the merchant bankers decide the IPO price band with the necessary steps.

Yes, in the bookbuilding IPO, investors can bid at any price within the given range.

Yes, the company can change the IPO price band before the issue closes.

In the IPO, Anyone can apply who has a bank account, PAN card, and demat account can apply.