Enter Communications was established in May 2008 and has since become a prominent player in the Indian Information technology-enabled services (ITES) sector, specializing in Client Interaction Management. Enter primary focus encompasses industries such as Insurance, e-commerce, Edtech, and Travel, among others, where they deliver tailor-made solutions to meet the unique requirements of their valued clients.

Enser’s core mission revolves around facilitating customer acquisition for their clients, thereby fostering mutual growth. Notable clients in their portfolio include innovative Insurance companies like Acko General Insurance, Reliance Nippon, and Ola Financial Services, and New Age companies such as India Lends, Doubtnut, Cordellia Cruises, and Mahindra Holidays amongst others.

Enser’s comprehensive service offerings span across Business Analytics, Customer Relationship Management (CRM), Interactive Voice Response Systems (IVRS), and Customer Interaction Management solutions. They take immense pride in elevating the top and bottom lines for all their clients. Enter Communications boasts a dedicated team of senior and middle management professionals well-versed in various technology, software, and client interaction solutions. Their linguistic diversity extends to North, South, and West India, enabling us to serve clients proficiently in multiple languages.

Objects of the Issue:

- To invest in IT Infrastructure

- To meet the Working Capital requirements of the Company

- To meet the General Corporate Purposes

- To meet the Issue Expenses

Enser Communications IPO Review

- May Apply

Enser Communications IPO Date & Price Band Details

| IPO Open: | March 15, 2024 |

| IPO Close: | March 19, 2024 |

| IPO Size: | Approx ₹16.17 Crores, 2,310,000 Equity Shares |

| Face Value: | ₹10 Per Equity Share |

| IPO Price Band: | ₹70 Per Equity Share |

| IPO Listing on: | NSE SME |

| Retail Quota: | 50% of the net offer |

| NII Quota: | 50% of the net offer |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors in IPO: | Click Here |

Enser Communications IPO Market Lot

The Enser Communications IPO minimum market lot is 2000 shares with a ₹140,000 application amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 2000 | ₹140,000 |

| Retail Maximum | 1 | 2000 | ₹140,000 |

| S-HNI Minimum | 2 | 4000 | ₹280,000 |

Enser Communications IPO Dates

The Enser Communications IPO date is March 15 and the IPO close date is March 19. The IPO allotment date is March 20 and the IPO might list on March 22.

| IPO Open Date: | March 15, 2024 |

| IPO Close Date: | March 19, 2024 |

| Basis of Allotment: | March 20, 2024 |

| Refunds: | March 21, 2024 |

| Credit to Demat Account: | March 21, 2024 |

| IPO Listing Date: | March 22, 2024 |

You can check IPO subscription status and IPO allotment status on their respective pages.

Enser Communications IPO Form

How to apply Enser Communications IPO? You can apply Enser Communications IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Enser Communications IPO in the Invest section. The other option you can apply Enser Communications IPO via IPO forms download via the NSE website. Check out the Enser Communications forms – click NSE IPO Forms download, fill and submit in your bank or with your broker.

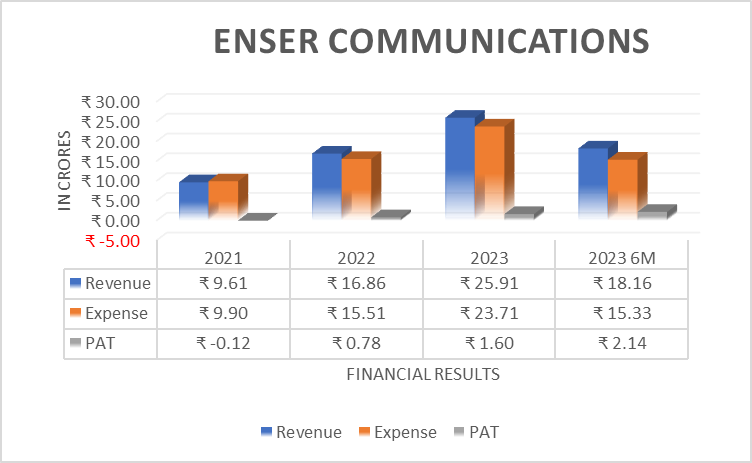

Enser Communications Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2021 | ₹9.61 | ₹9.90 | ₹0.12 |

| 2022 | ₹16.86 | ₹15.51 | ₹0.78 |

| 2023 | ₹25.91 | ₹23.71 | ₹1.60 |

| 2023 6M | ₹18.16 | ₹15.33 | ₹2.14 |

Enser Communications IPO Valuation – FY2023

Check Enser Communications IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| Earning Per Share (EPS): | ₹2.66 per Equity Share |

| Price/Earning P/E Ratio: | 26.32 |

| Return on Net Worth (RoNW): | 0.41% |

| Net Asset Value (NAV): | ₹10.84 per Equity Share |

Peer Group

- One Point One Solutions Ltd.

- Hinduja global solutions Ltd.

- eClerx Services Ltd.

Company Promoters

- Mr. Harihara Subramanian Iyer

- Mr. Rajnish Omprakash Sarna

- Mr. Rajnish Omprakash Sarna

- Mrs. Sindhu Saseedharan Nair

Enser Communications IPO Registrar

Skyline Financial Services Private Ltd

Phone: 02228511022

Email: [email protected]

Website: https://www.skylinerta.com/ipo.php

Enser Communications IPO Allotment Status

Check Enser Communications IPO allotment status on Skyline Financial website URL. Click Here

Enser Communications IPO Lead Managers aka Merchant Bankers

- Fast Track Finsec Pvt Ltd

Company Address

Enser Communications Limited

5 th Floor, 501-506,

Arihant Aura Turbhe,

Navi Mumbai, Sanpada Thane – 400703

Phone: 0124-4258077

Email: [email protected]

Website: http://www.enser.co.in/