Online Automobile classified platform CarTrade raised ₹900 crore from anchor investors on August 06, 2021 Friday before the IPO. The CarTrade IPO to open on Monday. The company allotted total of 55,59,664 equity shares to 43 anchor investors at a upper price band ₹1618. The anchor investors list includes Nomura, HSBC Global, Goldman Sachs, Jupiter India Fund, Elara India Opportunities Fund, Aditya Birla Sun Life Insurance Company, Bajaj Allianz Life Insurance Company, Bharti Axa Life Insurance Company, Axis Mutual Fund (MF), HDFC MF, Kotak MF and Sundaram MF. The company is going to raise ₹2998 crores via IPO that comprises the full amount of offer for share of their existing share holders. Check out the final list of CarTrade Anchor Investors given below:

List of CarTrade Anchor Investors:

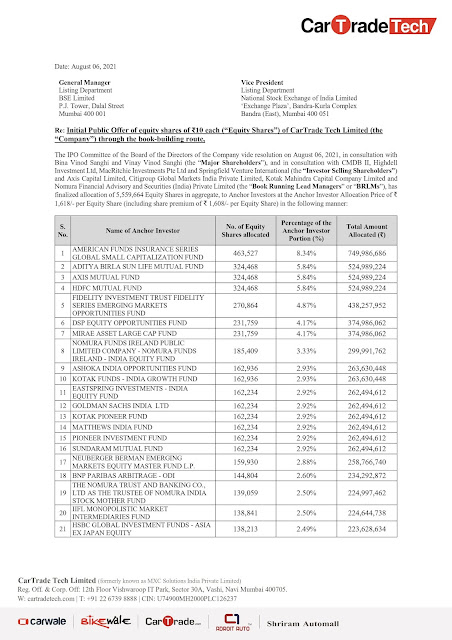

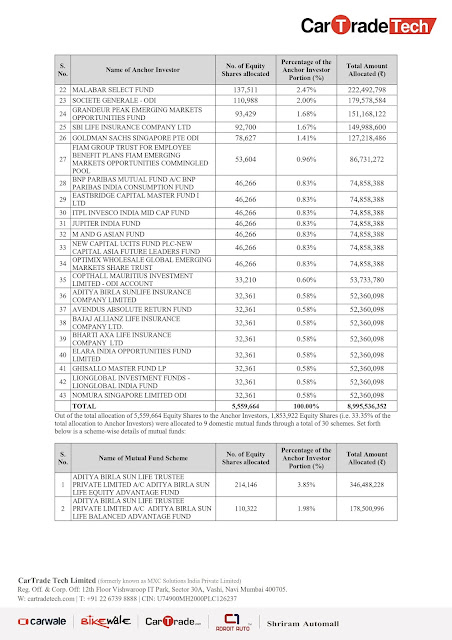

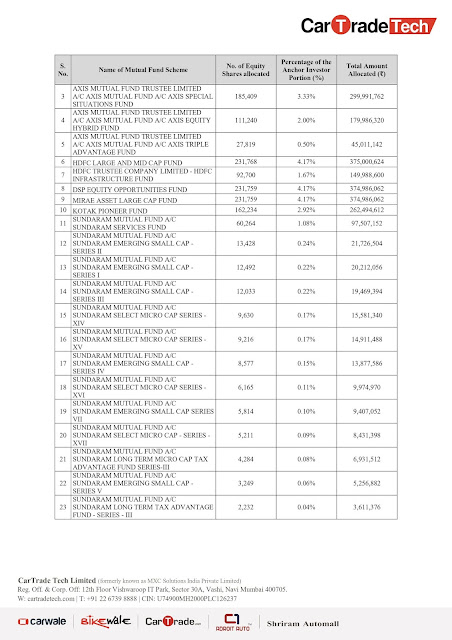

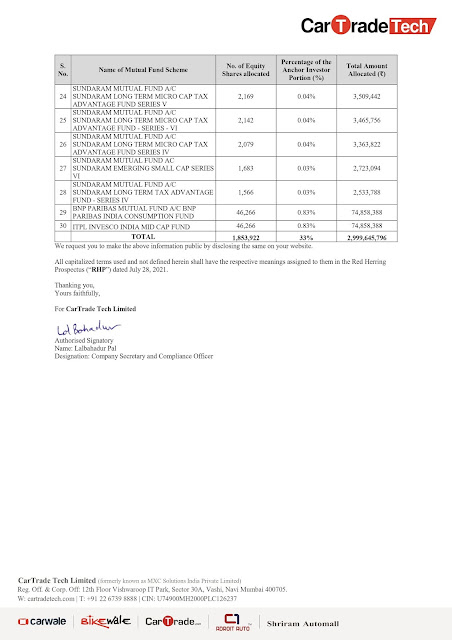

The IPO Committee of the Board of the Directors of the Company vide resolution on August 06, 2021, in consultation with Bina Vinod Sanghi and Vinay Vinod Sanghi (the “Major Shareholders”), and in consultation with CMDB II, Highdell Investment Ltd, MacRitchie Investments Pte Ltd and Springfield Venture International (the “Investor Selling Shareholders”) and Axis Capital Limited, Citigroup Global Markets India Private Limited, Kotak Mahindra Capital Company Limited and Nomura Financial Advisory and Securities (India) Private Limited (the “Book Running Lead Managers” or “BRLMs”), has finalized allocation of 5,559,664 Equity Shares in aggregate, to Anchor Investors at the Anchor Investor Allocation Price of ₹1,618/- per Equity Share (including share premium of ₹1,608/- per Equity Share) in the following manner:

Source: BSEIndia

The CarTrade IPO to open on 09 August and closes on 11 August 2021. The price band is fixed at ₹1585 to ₹1618. The CarTrade IPO application minimum bid is 9 Shares (₹14,562) and maximum bid is 117 shares (₹189,306). The Book Running Lead Managers of the IPO are Axis Capital Limited, Citigroup Global Markets India Private Limited, Kotak Mahindra Capital Company Limited and Nomura Financial Advisory And Securities (India) Pvt Ltd.