Akme Fintrade aka Aasaan Loans is a non-banking finance company (“NBFC”) incorporated in the year 1996 and registered with the Reserve Bank of India as a Non-systemically important non-deposit-taking company with over two decades of lending experience in rural and semi-urban geographies in India. The company is primarily engaged in rural and semi-urban-centric lending solutions to look after the needs and aspirations of the rural and semi-urban populace.

Aasaan Loans portfolio includes Vehicle Finance and Business Finance Products for small business owners. They have a long history of serving rural and semi-urban markets with high growth potential and have maintained a track record of financial performance and operational efficiency through consistently high rates of customer acquisition and retention and low-cost expansion into underpenetrated areas.

Akme Fintrade has footprints in rural and semi-urban geographies in 4 Indian states Rajasthan, Maharashtra, Madhya Pradesh, and Gujarat through a registered office located at Udaipur, Rajasthan, and a Corporate Office located in 226 Mumbai, Maharashtra, 12 branches and over 25 points of presence including digital and physical branches having served over 2,00,000 customers till date.

The company has a digital lending platform www.aasaanloans.com is going live soon. This digital lending platform has been currently deployed to a select group of users for User Acceptance Testing (UAT), specifically focusing on Two-wheeler finance as the initial phase. The product for loan against property, commercial vehicle financing, and secured business loans, will be introduced in a phased manner.

Objects of the Issue

- Re-payment or pre-payment, in full or in part, of certain borrowings availed by the Company.

- Infusion of funds in certain of our Subsidiaries, namely Signatureglobal Homes, Signature Infrabuild, Signatureglobal Developers, and Sternal Buildcon for re-payment or pre-payment, in full or in part, of certain borrowings availed by the Subsidiaries.

- Inorganic growth through land acquisitions and general corporate purposes.

Akme Fintrade IPO Review (Apply or Not)

- Avoid

Brokerage Firm IPO Review

- Swastika Investmart: Neutral

Akme Fintrade (Aasaan Loans) IPO Date & Price Band Details

| IPO Open: | June 19, 2024 |

| IPO Close: | June 21, 2024 |

| IPO Size: | Approx ₹132 Crores |

| Fresh Issue: | Approx ₹132 Crores |

| Face Value: | ₹10 Per Equity Share |

| IPO Price Band: | ₹114 to ₹120 Per Share |

| IPO Listing on: | BSE & NSE |

| Retail Quota: | 35% |

| QIB Quota: | 50% |

| NII Quota: | 15% |

| Discount: | N/A |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors List: | Click Here |

Akme Fintrade IPO Market Lot

The Akme Fintrade IPO minimum market lot is 125 shares with ₹15,000 application amount. The retail investors can apply up-to 13 lots with 1,625 shares or ₹195,000 amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 125 | ₹15,000 |

| Retail Maximum | 13 | 1,625 | ₹195,000 |

| S-HNI Minimum | 14 | 1,750 | ₹210,000 |

| B-HNI Minimum | 68 | 8,375 | ₹1,005,000 |

Akme Fintrade IPO Allotment & Listing Dates

The Akme Fintrade IPO date is June 19 and the close date is June 21. The Akme Fintrade IPO allotment will be finalized on June 24 and the IPO listing on June 26.

| IPO Open Date: | June 19, 2024 |

| IPO Close Date: | June 21, 2024 |

| Basis of Allotment: | June 24, 2024 |

| Refunds: | June 25, 2024 |

| Credit to Demat Account: | June 25, 2024 |

| IPO Listing Date: | June 26, 2024 |

You can check IPO subscription status and IPO allotment status on their respective pages.

Akme Fintrade (Aasaan Loans) IPO Form

How to apply for the Akme Fintrade IPO? You can apply for Akme Fintrade IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Akme Fintrade IPO in the Invest section. The other option is you can apply for Akme Fintrade IPO via IPO forms downloaded via NSE and BSE. Check out the Akme Fintrade forms – Click BSE Forms & NSE Forms blank IPO forms download, fill, and submit in your bank or with your broker.

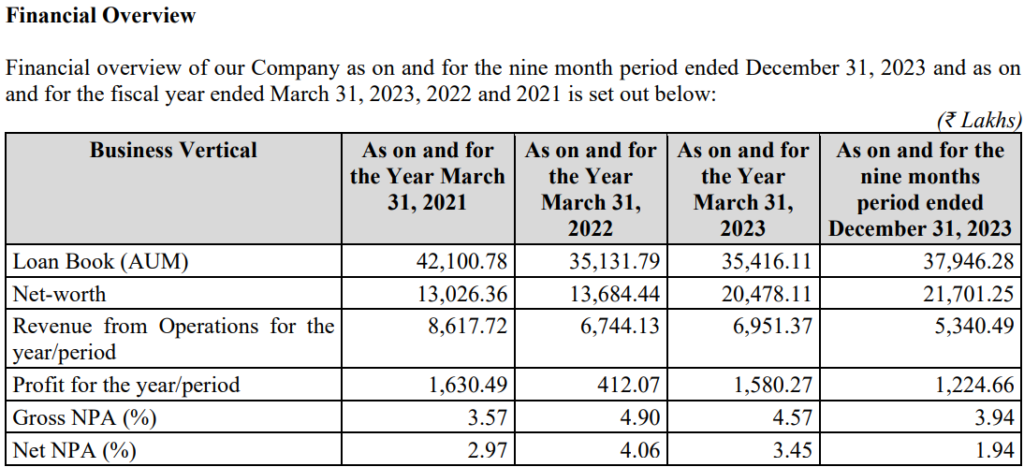

Akme Fintrade Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2021 | ₹86.79 | ₹67.59 | ₹16.31 |

| 2022 | ₹67.50 | ₹59.91 | ₹4.12 |

| 2023 | ₹69.57 | ₹49.52 | ₹15.80 |

| Dec 2023 | ₹53.45 | ₹38.29 | ₹12.25 |

Akme Fintrade IPO Valuation – FY2023

Check Akme Fintrade IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| Earning Per Share (EPS): | ₹5.85 per Equity Share |

| Price/Earning P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 9.25% |

| Net Asset Value (NAV): | ₹64.65 per Equity Share |

Peer Group

- NA

Company Promoters

- NIRMAL KUMAR JAIN

- MANJU DEVI JAIN

- DIPESH JAIN

- NIRMAL KUMAR JAIN HUF

Akme Fintrade IPO Registrar

Bigshare Services Pvt Ltd

Phone: +91-22-6263 8200

Email: ipo@bigshareonline.com

Website: https://bigshareonline.com/

Akme Fintrade IPO Allotment Status Check

Check Akme Fintrade IPO allotment status on Bigshare website allotment URL. Click Here

Akme Fintrade IPO Lead Managers aka Merchant Bankers

- Gretex Corporate Services Limited

Company Address

Akme Fintrade India Ltd

AKME Business Centre (ABC),

4-5 Subcity Centre, Savina Circle opp

Krishi Upaz Mandi Udaipur,- 313002

Phone: +91- 294-2489501

Email: cs@aasaanloans.com

Website: https://aasaanloans.com/

Akme Fintrade IPO FAQs

What is Akme Fintrade IPO?

When Akme Fintrade IPO will open?

What is Akme Fintrade IPO Investors Portion?

How to Apply the Akme Fintrade IPO?

How to Apply the Akme Fintrade IPO through Zerodha?

How to Apply the Akme Fintrade IPO through Upstox?

How to Apply the Akme Fintrade IPO through Paytm Money?

What is Akme Fintrade IPO Size?

What is Akme Fintrade IPO Price Band?

What is the Akme Fintrade IPO Allotment Date?

What is the Akme Fintrade IPO Listing Date?

Note: The Akme Fintrade IPO price band and date are officially announced yet. The IPO grey market premium (Akme Fintrade IPO Premium) will be added to the IPO grey market page as it will start).