IIFL Home Finance NCD Issue Details

| NCD Issue Open | 06 July 2021 |

| NCD Issue Close | 28 July 2021 |

| NCD Issue Size | Base: 100 Cr. | Shelf: 900 Cr. |

| Price Band | ₹1000 per NCD |

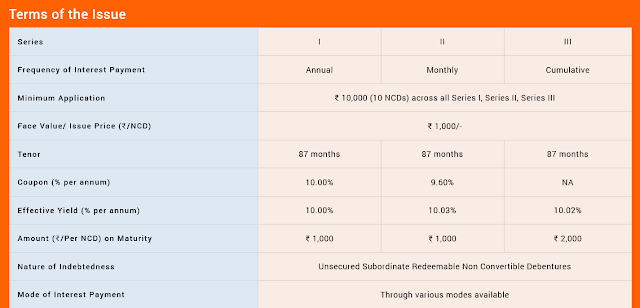

| Interest Rate | Upto 10% ** (Annually) |

| Minimum Investment | 10 Bonds (₹10,000) |

| Maximum Investment | 1,000 Bonds (₹10,00,000) |

| Listing on |

BSE, NSE Platform |

IIFL Home Finance NCD Issue Rating

- CARE Ratings: CARE BB+; Stable (Double BB plus; Outlook: Stable)

IIFL Home Finance NCD Issue Listing

- NCD Bonds will be list on BSE & NSE.

IIFL Home Finance NCD Issue Promoters

- IIFL Finance Limited (formerly known as IIFL Holdings Limited).

How to Apply IIFL Home Finance NCD Issue?

You can apply from your existing demat account online and offline. You can apply via downloading form from the official website and filling up all the details with the cheque of said amount. You can submit it to the collection centers (Apply IIFL Home Finance NCD).

IIFL Home Finance NCD (July 2021) Issue Tenure & Interest Rates

About IIFL Home Finance

IIFL Home Finance Limited, a wholly-owned subsidiary of IIFL Finance, is a registered housing finance company with National Housing Bank (NHB) engaged in the business of home loans, secured business loans and affordable housing project finance loans. IIFL Home Finance Limited has a long term credit rating of AA by Crisil & AA+ by Brickwork.

IIFL Home Finance NCD Lead Manager

- Equirus Capital Private Limited

- Trust Investment Advisors Private Limited

IIFL Home Finance NCD Allotment Status

- IIFL Home Finance NCD issue allotment available on Linkintime

NCD Registrar

Link Intime India Private Ltd

C 101, 247 Park, L.B.S.Marg,

Vikhroli (West), Mumbai – 400083

Phone: +91-22-4918 6270

Email: [email protected]

Website: http://www.linkintime.co.in

Company Information

IIFL Home Finance Ltd

IIFL House, Sun Infotech Park, Road No. 16V,

Plot No. B-23, MIDC, Thane Industrial Area,

Wagle Estate, Thane – 400604, Maharashtra, India

Phone: +91 22 4103 5000

Email: [email protected]

Website: https://www.iifl.com/home-loans