What is an IPO?

➤ IPO full form:

IPO (Initial Public Offering) is the process through which a private company becomes publicly listed. Through an IPO, a private company becomes publicly traded on stock exchanges such as the NSE and the BSE. Where investors (the Public) can buy and sell the firm’s stock.

An IPO also helps capital providers to know the company’s financial background, performance, business model, and risks and rewards.

To cite an example:

- ABC Pvt. Ltd. is preparing to go public. In order to be listed on the stock exchange, the company needs to complete the Initial Public Offering (IPO) process.

➤ Bookbuilding IPO

Book building is a process selected by a company to decide the price of its shares when going public, by inviting bids from investors within a pre-set price range.

➤ Fixed price IPO

In a fixed price IPO, the company decides a single offer price at which shares are sold to all categories of investors.

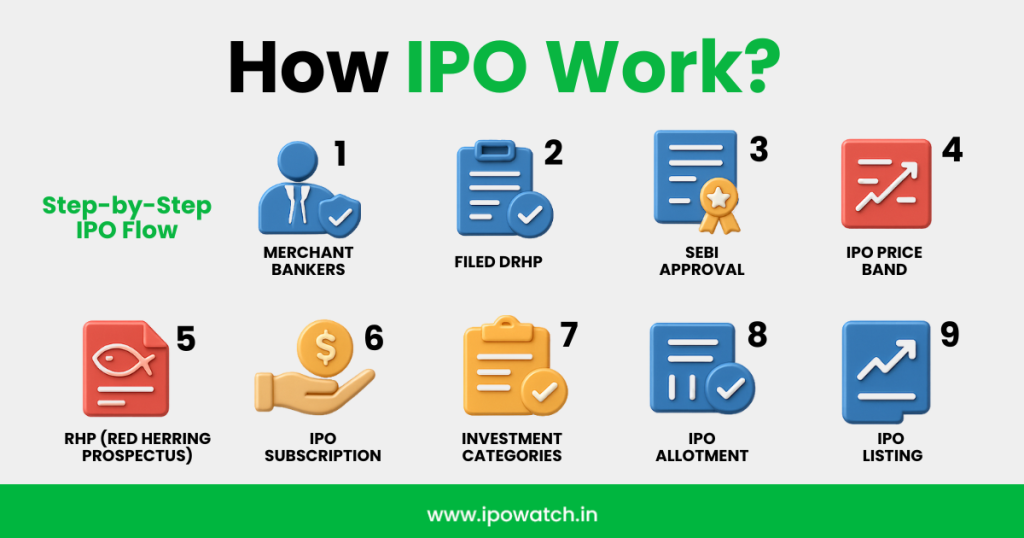

How IPO work?

Here is the IPO explained step by step

Merchant bankers:

Merchant bankers are one of the major parts of IPO, as they take all the responsibilities for launching IPOs. From suggesting a company for the perfect time for IPO to the DRHP filing process, merchant bankers are the key.

They decide the IPO issue size and proper timing, price band, and other details like fresh issue/ OFS.

The work is not completed here; in fact, they prepare the DRHP, with all the details of the company.

Filed DRHP

DRHP (Draft Red Herring Prospectus) is the document that is submitted to the SEBI for the IPO process.

DRHP is informative for investors as it has financial structure details, industry growth, IPO details, and also where IPO money will be expensed.

SEBI Approval

After the company files the DRHP, SEBI reviews, and as per the requirement, merchant bankers or the company should make some changes before continuing with the IPO process.

IPO Price band

The issue price is the final price that investors pay for buying shares.

RHP (red Herring Prospectus)

The RHP is a Red Herring Prospectus is considered the final document for IPO after the DRHP. The RHP can be filed with some changes, such as deciding the IPO price band.

IPO Subscription

After the above process, IPO subscription starts, which could last around 3 to 5 days. Especially, in the mainboard IPO, the subscription duration is usually 3 days, while in an SME IPO, it can be either 3 or 5 days.

Investment categories

Investor categories are different, such as retailers, S-HNI, B-HNI, QIB, and Anchor investors.

IPO Allotment

On IPO allotment day, investors would know via email or text message, or by self-checking on the IPO registrar websites.

IPO Listing

Allottees received shares in their demat account, and non-allottees get a refund. On the IPO listing day, the shares are listed on the stock exchanges, and trading starts.

Apart from it, the IPO has also demand in the unofficial market, and the GMP is the sign for a demanded IPO.

What is GMP, and how does an IPO perform in the primary and secondary markets?

The GMP reflects the premium which investors are willing to pay over the IPO’s issue price.

During these days, the IPO GMP (Grey Market Premium) has fluctuated, which reflects the demand for the particular IPO in the unofficial market.

For example:

If any IPO has been decided price band of ₹120, and the GMP is ₹20, which means in the unofficial market, the investors are willing to pay for extra ₹20 on the price band; therefore, might a chance that, IPO could be listed at ₹140 on the stock exchanges.

Furthermore, the grey market premium is also beneficial for the shares’ prediction in the secondary market.

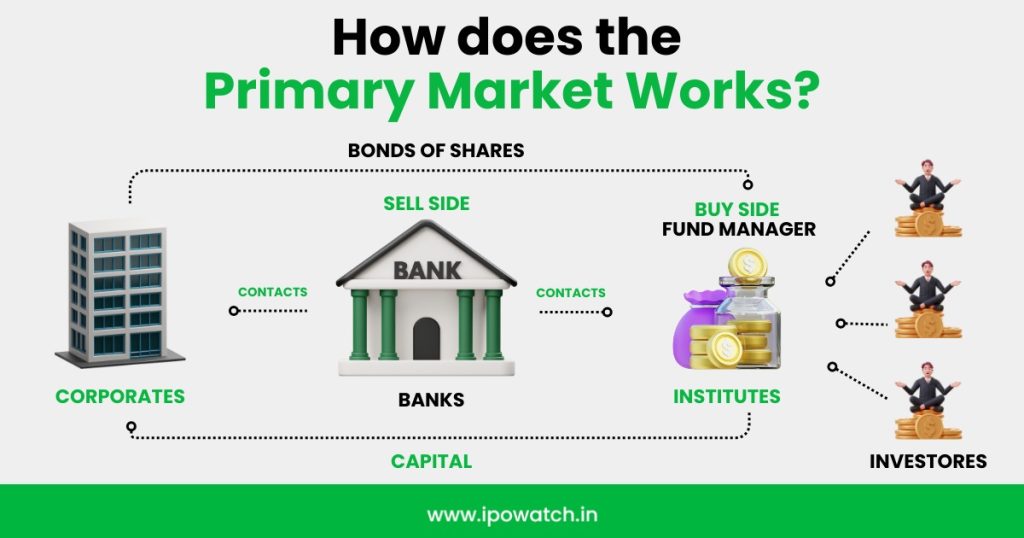

What secondary market?

After the IPO process, the shares are listed in the secondary market.

The secondary market, where the company’s shares are being traded where investors can buy & sell and secure their profit and loss.

Not only shares but also other securities, such as debentures, bonds, etc, investors can trade on them. The price of shares in the secondary market is determined by supply and demand.

What are the reasons for a company to launch an IPO?

Launching an IPO could have various reasons, are given below.

Capital Raising: The company launches an IPO intending to raise money for the enhancement of its business, such as new accessories for products, opening new offices, factories, and many more.

Fulfilment of debt: IPO money could also be utilized for the fulfillment of the company’s debt.

Increase credibility: Large institutions such as banks, mutual funds, trusts, pension funds, and corporate investors are more likely to trust a company going public because the IPO process requires the firm to disclose all important financial and operational information.

Increase the Company’s Valuation: When a company goes public with accurate information and strong finances, it can raise its market value because investors can see that the company is trustworthy and profitable.

FAQs

Who are merchant bankers in an IPO?

Who can invest in an IPO?

What is Issue Size?

Who are Anchor Investors?

What is the secondary market?

Do IPOs always give profit?

GMP only indicates market sentiment, not guaranteed returns.

What is the Fresh Issue and OFS?

What is the difference between DRHP and RHP?

RHP = Final document with confirmed details like price band, issue dates, and updated information.