The IPO contains both fresh issues and offer-for-sale (OFS). In fresh issue it contains shares up to ₹75,000 lakhs while in offer-for-sale it provides up to 36,00,000 Equity Shares by promoters. According to DRHP, the face value of the offering is ₹10 per Equity Share.

The Names of Selling Shareholders are Sangamesh Rudrappa Nirani and Dhraksayani Sangamesh Nirani. Both are selling up to 18,000,000 equity shares each.

Bigshare Services Private Limited acts as the Registrar of this offering and the book-running lead managers for this IPO are SBI Capital Markets Limited and DAM Capital Advisors Limited.

The funding from this offering will be utilized for the company’s capital requirements, for general corporate uses and setting up multi-feed stock operations to clear the way for using grains as an additional raw material in ethanol plants at TBL Unit 4 of 300 KLPD capacity.

The company is planning the pre-IPO placement up to ₹ 15,000 lakhs. If the Pre-IPO Placement is completed, the amount raised through the Pre-IPO Placement will be reduced from the Fresh Issue.

TruAlt Bioenergy is headquartered in Karnataka. The company invested significantly in expanding its production capacity which allowed it to produce ethanol on a larger scale compared to its competitors. TruAlt Bioenergy stands out with a highest market share of 3.7% by capacity during FY 2024, driven by its robust capacity expansion. TruAlt Bioenergy has a successful track record of increasing the distillation capacity from 390 KLPD to 1,400 KLPD in less than 3 years and become India’s largest ethanol producer by installed capacity as of December 31, 2023.

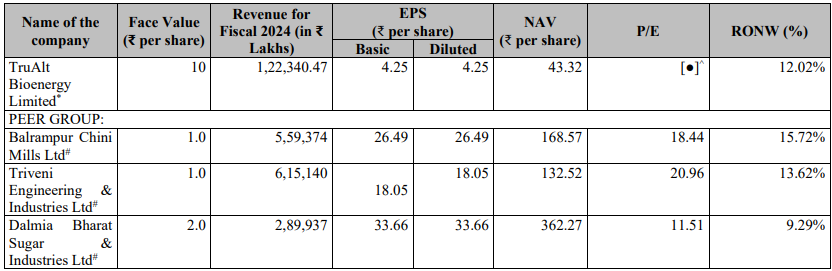

The company’s net profit has been Rs 31.8 crores as of March 2024, which is lower than last year’s Rs 35.5 crores. However, during the same time, operating revenue has increased significantly to Rs 1,223.4 crores from Rs 762.4 crores.

For FY24, EBITDA increased by 79% to Rs 188 crore on an operational basis, with a margin expansion of 160 basis points to 15.4%