Phytochem Remedies IPO is to open on December 18, 2025. It is a SME IPO that will raise ₹38.22 crores. The Phytochem Remedies IPO price band is fixed at ₹98 with a market lot of 2,400 Shares.

Phytochem Remedies IPO GMP Live Rates day by day with Kostak rates.

| Date | IPO GMP | GMP Trend | Gain |

| 24 Dec | ₹- | – | -% |

| 23 Dec | ₹- | – | -% |

| 22 Dec | ₹- | – | -% |

| 20 Dec | ₹- | – | -% |

| 19 Dec | ₹- | – | -% |

| 18 Dec | ₹- | – | -% |

| 17 Dec | ₹- | – | -% |

| 16 Dec | ₹- | – | -% |

| 15 Dec | ₹- | – | -% |

Phytochem Remedies IPO Details

Phytochem Remedies IPO Dates

| IPO Open Date: | December 18, 2025 |

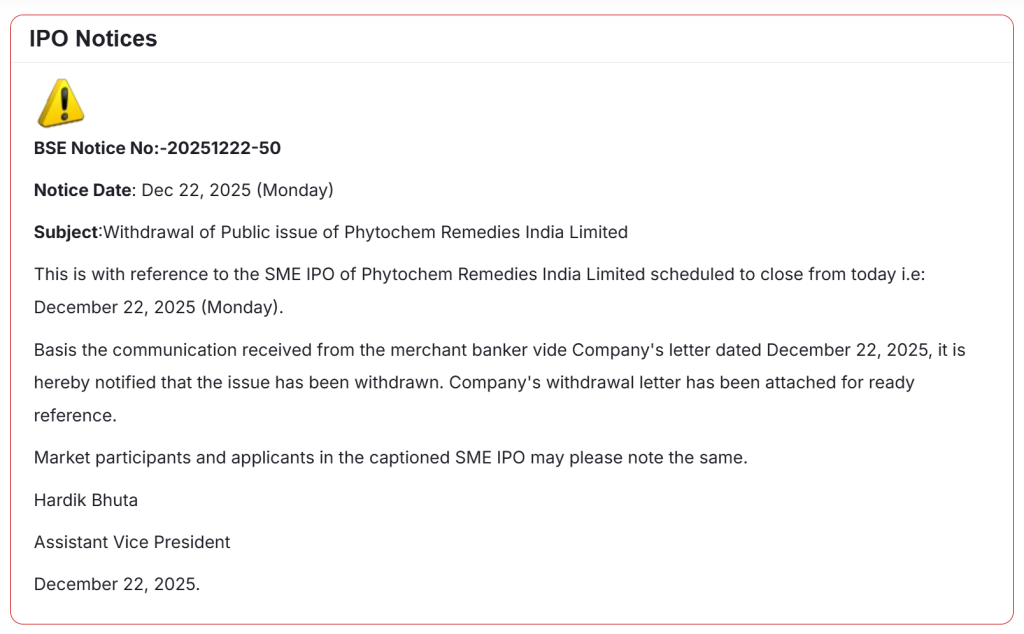

| IPO Close Date: | December 22, 2025 |

| Basis of Allotment: | December 23, 2025 |

| Refunds: | December 24, 2025 |

| Credit to Demat Account: | December 24, 2025 |

| IPO Listing Date: | December 26, 2025 |

| IPO Bidding Cut-off Time: | December 22, 2025 – 5 PM |

Business Overview

Since its incorporation in 2002, Phytochem Remedies Limited has been involved in the manufacturing of corrugated boxes and corrugated boards. The type of material used for packing, storage, and transportation is due to its lightweight, strong, and cost-effective nature. The company serves its solutions to the food & beverages, FMCG, pesticides, pharmaceuticals, and automotive industries.

The company includes 51 employees as of September 2025. Moreover, the company operates 2 manufacturing units situated at Bari Brahmana, Jammu. Unit 1 covers 43,360 sq. ft and Unit 2 covers 1,73,440 sq. ft. Its product portfolio consists of a wide range of products such as Corrugated Boxes (3-Ply, 5-Ply, & 7-Ply), Printed Corrugated Boxes, Corrugated Rolls, and Corrugated Pads and Sheets.

Phytochem Remedies IPO GMP aka Grey Market Premium FAQs:

What is Phytochem Remedies IPO GMP Today?

What is Phytochem Remedies IPO Expected Returns?

Disclaimer:

- IPO Grey Market Premium (Phytochem Remedies IPO GMP) mention is valid for the specific date as mentioned in the header.

- We are not buying and selling IPO forms on IPO Grey Market.

- Kostak Rate is the premium one gets by selling his/her IPO application (in an off-market transaction) to someone else even before allotment or listing of the issue.

- Do not subscribe for IPO by just seeing the premium Price as it may change anytime before listing. Subscribe only considering the fundamentals of the companies.