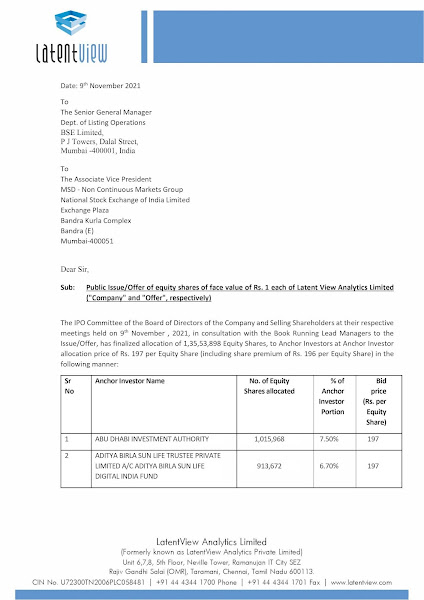

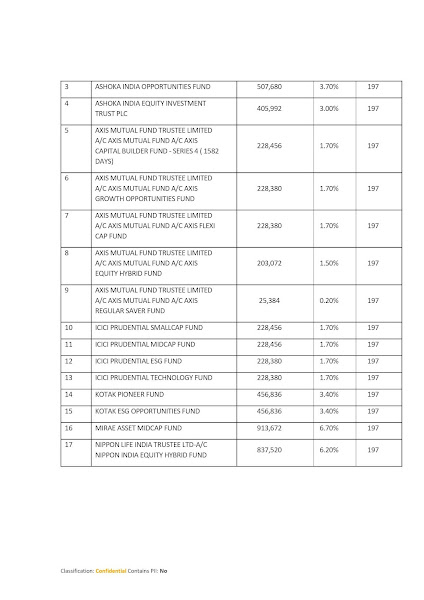

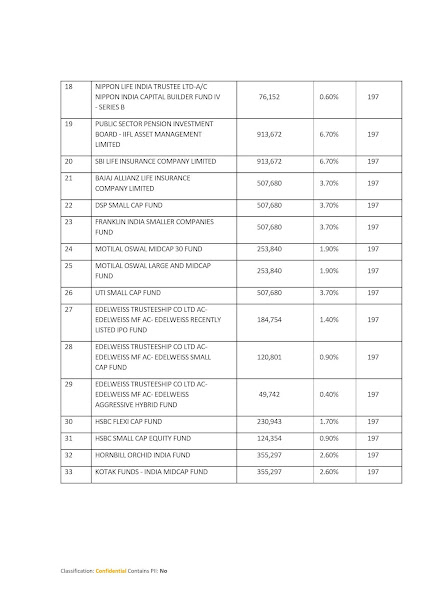

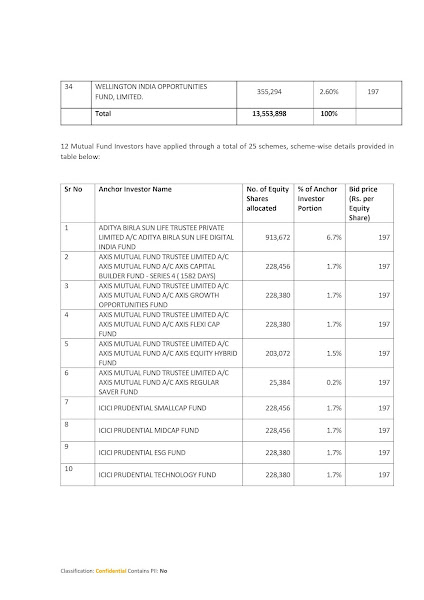

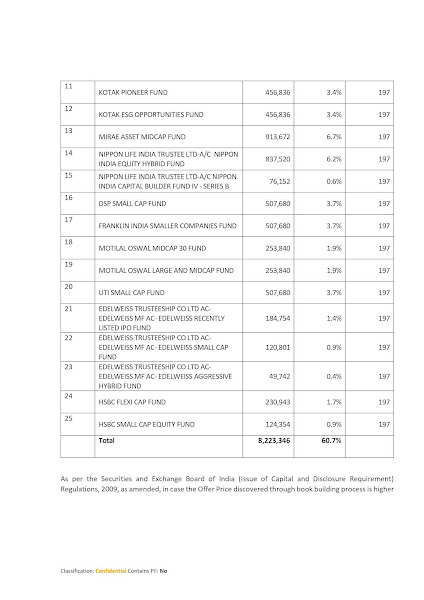

A recognized leader in Data and Analytics and a trusted partner to Fortune500 companies Latent View Analytics raised ₹267 crores from anchor investors on November 09, 2021 Tuesday before the IPO. The Latent View Analytics IPO to open on November 10, Wednesday. The company allotted total of 1,35,34,898 equity shares to 34 Anchor investors at a upper price band ₹197. The anchor investors list includes 12 Mutual Funds through a total of 25 schemes. The company is going to raise ₹600 crores via IPO. Check out the final list of Latent View Analytics Anchor Investors given below:

List of Latent View Analytics Anchor Investors:

The IPO Committee of the Board of Directors of the Company and Selling Shareholders at their respective meetings held on 9th November, 2021, in consultation with the Book Running Lead Managers to the Issue/Offer, has finalized allocation of 1,35,34,898 Equity Shares, to Anchor Investors at Anchor Investor allocation price of ₹197 per Equity Share (including share premium of ₹196 per Equity Share. The details are given below: