Kross IPO Review

- IPO Watch – May Apply

- Canara Bank –

- DRChoksey FinServ –

- Emkay Global –

- Hem Securities –

- IDBI Capital –

- Marwadi Shares –

- Nirmal Bang –

- SBICAP Securities –

- Sharekhan –

- SMC Global –

- Sushil Finance –

- Swastika Investmart –

- Ventura Securities –

- Geojit –

- Reliance Securities –

- Capital Market –

- BP Wealth –

- ICICIdirect –

- Choice Broking –

Kross IPO Details

| IPO Open Date: | September 9, 2024 |

| IPO Close Date: | September 11, 2024 |

| Face Value: | ₹5 Per Equity Share |

| IPO Price Band: | ₹228 to ₹240 Per Share |

| Issue Size: | Approx ₹500 Crores |

| Fresh Issue: | Approx ₹250 Crores |

| Offer for Sale: | Approx 10,416,667 Equity Shares |

| Issue Type: | Book Built Issue |

| IPO Listing: | BSE & NSE |

| Retail Quota: | Not more than 35% |

| QIB Quota: | Not more than 50% |

| NII Quota: | Not more than 15% |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors List: | Click Here |

Kross IPO IPO Market Lot

The Kross IPO minimum market lot is 62 shares with ₹14,880 application amount. The retail investors can apply up-to 13 lots with 806 shares or ₹193,440 amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 62 | ₹14,880 |

| Retail Maximum | 13 | 806 | ₹193,440 |

| S-HNI Minimum | 14 | 868 | ₹208,320 |

| B-HNI Minimum | 68 | 4,216 | ₹1,011,840 |

Kross IPO Dates

The Kross IPO date is September 9 and the close date is September 11. The Kross IPO allotment will be finalized on September 12 and the IPO listing on September 16.

| IPO Open Date: | September 9, 2024 |

| IPO Close Date: | September 11, 2024 |

| Basis of Allotment: | September 12, 2024 |

| Refunds: | September 13, 2024 |

| Credit to Demat Account: | September 13, 2024 |

| IPO Listing Date: | September 16, 2024 |

Promoters of Kross IPO

The promoters of the company are Sudhir Rai and Anita Rai.

About Kross IPO

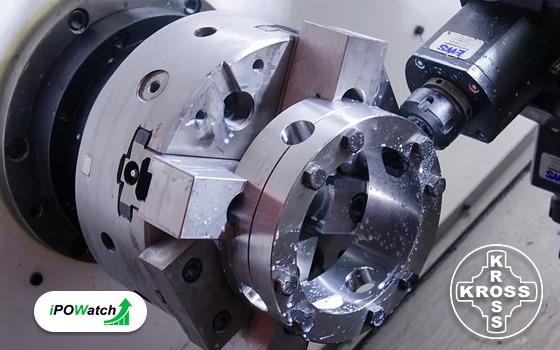

Kross Limited was Established in the year 1994. The company manufactures a wide variety of high-performance, vital safety components for the tractor, trailer axle, and commercial vehicle industries. They employ innovative machinery including upsetters, forging presses, precision machining tools, foundries, and specialized software for custom services at their five manufacturing facilities in Jamshedpur, Jharkhand.

The company supplies its products to a diversified client base, including large original equipment manufacturers (OEMs), domestic dealers, and fabricators. Currently, the company manufactures a large variety of components and has the capacity to manufacture forged parts of up to 40 kg input weight. It is expanding its capacity and increasing product offerings through the expansion of existing facilities and the addition of further production lines.

Kross IPO Company Financial Report

The company reported revenue of ₹621.46 crores in 2024 against ₹489.36 crores in 2023. The company reported a profit of ₹44.88 crores in 2024 against a profit of ₹30.93 crores in 2023.

Amount ₹ in Crores

| Period Ended | Revenue | Expense | Profit After Tax | Assets |

| 2022 | ₹297.88 | ₹281.57 | ₹12.17 | ₹197.82 |

| 2023 | ₹489.36 | ₹447.65 | ₹30.93 | ₹250.57 |

| 2024 | ₹621.46 | ₹560.17 | ₹44.88 | ₹352.00 |

Kross IPO Valuation – FY2024

Check Kross IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| KPI | Values |

| ROE: | 30.57% |

| ROCE: | 28.15% |

| EBITDA Margin: | 13.02% |

| PAT Margin: | 7.22% |

| Debt to equity ratio: | 0.80 |

| Earning Per Share (EPS): | ₹8.30 (Basic) |

| Price/Earning P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 30.57% |

| Net Asset Value (NAV): | ₹27.14 |

Peer Group Comparison

| Company | EPS | PE Ratio | RoNW % | NAV | Income |

| Ramkrishna Forgings Limited | 20.27 | 46.55 | 12.72 | 148.48 | 3954.88 Cr. |

| Jamna Auto Industries Limited | 5.15 | 24.30 | 22.74 | 22.64 | 2426.77 Cr. |

| Automotive Axles Limited | 109.95 | 17.05 | 18.97 | 579.63 | 2229.17 Cr. |

| GNA Axles Limited | 23.28 | 17.32 | 12.47 | 186.69 | 1506.26 Cr. |

| Talbros Automotive Components Limited | 17.82 | 19.03 | 20.47 | 87.02 | 778.27 Cr. |

Objects of the Issue

- Funding of capital expenditure requirements of the Company towards the purchase of machinery and equipment;

- Repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by the Company, from banks and financial institutions;

- Funding working capital requirements of the Company; and

- General corporate purposes

Kross IPO Registrar

KFin Technologies Limited

Phone: 04067162222, 04079611000

Email: krosslimited.ipo@kfintech.com

Website: https://kosmic.kfintech.com/ipostatus/

IPO Lead Managers aka Merchant Bankers

- Equirus Capital Private Limited

Company Address

Kross IPO Limited

M-4, Phase VI, Gamharia,

Adityapur Industrial Area,

Jamshedpur – 832108

Phone: +91 0657 2203812

Email: investors@krossindia.com

Website: https://www.krosslimited.com/

Kross IPO FAQs

What is Kross IPO?

When Kross IPO will open for subscription?

What is Kross IPO Investors Portion?

How to Apply the Kross IPO?

What is Kross IPO Issue Size?

What is Kross IPO Price Band?

What is Kross IPO Lot Size?

What is the Kross IPO Allotment Date?

What is the Kross IPO Listing Date?

Note: The Kross IPO price band and date are officially announced. The (Kross IPO grey market premium) will be added to the IPO GMP page as it will start).

4 Responses

I my amount not unblock till today pls unblock the amount 14880

Mera announcement status nahi bata raha please mera announcement status dikhayen

Please let me know if the investment in Kross is worth for long-term gains or not??

Hi Mahesh,

Go for long term view.