Bharat Coking Coal IPO Details

BCCL IPO Review & Key Points

- Review: May Apply

- Rating: 4

Bharat Coking Coal IPO Market Lot

The Bharat Coking Coal IPO minimum market lot is 600 shares with ₹13,800 application amount. The retail investors can apply up to 13 lots with 8,400 shares of ₹1,93,200.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 600 | ₹13,800 |

| Retail Maximum | 14 | 8,400 | ₹1,93,200 |

| S-HNI Minimum | 15 | 9,000 | ₹2,07,000 |

| S-HNI Maximum | 72 | 43,200 | ₹9,93,600 |

| B-HNI Minimum | 73 | 43,800 | ₹10,07,400 |

About Bharat Coking Coal

Bharat Coking Coal Limited (BCCL), established in 1972, is one of the leading companies that mine and supply coking coal, non-coking coal, and washed coal. In 2014, the company received Mini Ratna status in the supply of coking coal serving the steel and power industries. The company runs its business with mines located at Jharia, Jharkhand, and Raniganj, West Bengal coalfields. Moreover, the company runs 32 mines, including 25 opencast, 3 underground, and 4 mixed mines as of March 31, 2025.

In FY25, the company’s coal production increased to 40.50 million tonnes. Furthermore, in FY25, the company has produced nearly 58.5% of India’s domestic coking coal. They operate their business with open and underground mines, coal washeries, reopening discontinued underground mines, and coal washeries that are stopped or lying unused for some time.

Strengths 👍

- Bharat Coking Coal Limited is the largest producer of coking coal in India. As of April 1, 2024, the company has 791 million tonnes of coal resources, making it the primary source of coking coal production in India.

- The demand for coking coal in India is expected to rise significantly, increasing from 67 million metric tonnes in FY25 to 138 million metric tonnes by FY35.

- The strong parentage of Coal India Limited gives it a strategic technological and financial strength for sustainable growth.

- The company is almost debt-free.

Weakness👎

- The company has contingent liabilities of ₹4,930 crore, representing potential future obligations that may arise in the future and can affect the business, cash flow, and financial condition.

- BCCL generates 87% of its revenue from its top 10 customers, and losing any of its key customers can adversely affect the business, financial condition, and cash flow.

- The IPO is entirely an Offer for Sale (OFS) with no fresh issue component, which means the proceeds will go to exiting shareholders and will not be used for the company’s growth.

- Other income of ₹598 crore comes from non-core activities.

- Debtor days have increased from 39.1 to 48.2 days.

IPO Reservation

| Investor Category | Share Offered | -% Shares |

| Anchor Investor | 11,87,53,500 Shares | 25.50% |

| QIB (Ex. Anchor) | 7,91,69,000 Shares | 17.00% |

| NII Shares Offered | 5,93,76,750 Shares | 12.75% |

| Retail Shares Offered | 13,85,45,750 Shares | 29.75% |

| Shareholder Quota Offers | 4,65,70,000 Shares | 10.00% |

| Employee Shares Offered | 2,32,85,000 Shares | 5.00% |

Bharat Coking Coal IPO Anchor Investors

Bharat Coking Coal IPO Dates

The Bharat Coking Coal IPO date is January 9, and the close date is January 13. The Bharat Coking Coal IPO allotment will be finalized on January 14, and the IPO listing will be on January 16.

| IPO Open Date: | January 9, 2026 |

| IPO Close Date: | January 13, 2026 |

| Basis of Allotment: | January 14, 2026 |

| Refunds: | January 15, 2026 |

| Credit to Demat Account: | January 15, 2026 |

| IPO Listing Date: | January 16, 2026 |

| IPO Bidding Cut-off Time: | January 13, 2026 – 5 PM |

Promoters and Holding Pattern

The promoters of the company are the President of India, Acting Through The Ministry of Coal, Government of India And Coal India Limited. Details Of The Offer to the Public.

| Particular | Shares | % Share |

| Promoter Holding Pre Issue | 4,65,70,00,000 | 100% |

| Promoter Holding Post Issue | 4,65,70,00,000 | 90% |

Objects of the Issue & Utilisation of Proceeds

- NA

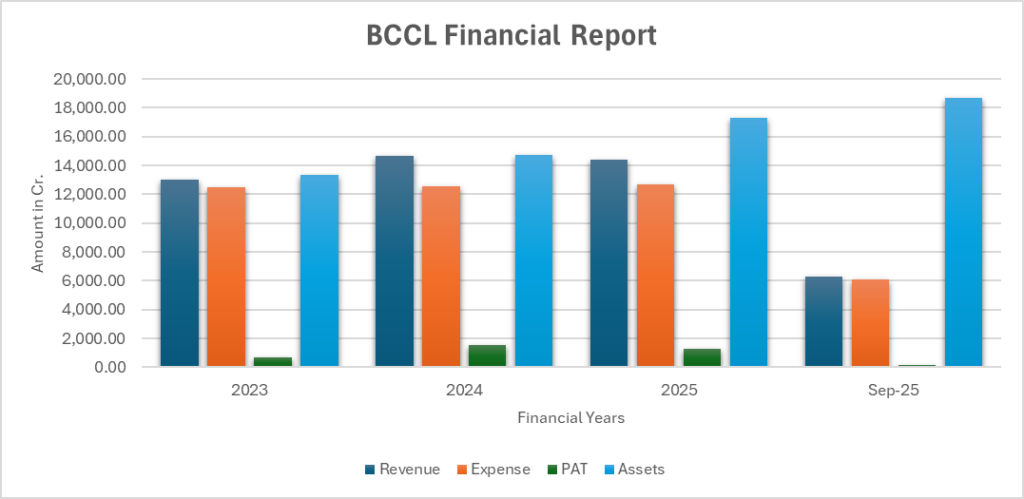

Bharat Coking Coal IPO Company Financial Report

Amount ₹ in Crores

| Period Ended | Revenue | Expense | PAT | Assets |

| 2023 | ₹13,018.57 | ₹12,488.38 | ₹664.78 | ₹13,312.86 |

| 2024 | ₹14,652.53 | ₹12,560.86 | ₹1,564.46 | ₹14,727.73 |

| 2025 | ₹14,401.63 | ₹12,698.74 | ₹1,240.19 | ₹17,283.48 |

| Sep 2025 | ₹6,311.51 | ₹6,112.17 | ₹123.88 | ₹18,711.13 |

Bharat Coking Coal IPO Valuation – FY2025

Check Bharat Coking Coal IPO valuations detail like Earnings Per Share (EPS), Price/Earnings P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| KPI | Values |

| ROE: | 20.83% |

| ROCE: | 30.13% |

| EBITDA Margin: | 16.36% |

| PAT Margin: | 8.61% |

| Debt to equity ratio: | – |

| Earning Per Share (EPS): | ₹2.66 (Basic) |

| Price/Earnings P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 20.83% |

| Net Asset Value (NAV): | ₹14.07 |

Peer Group Comparison

| Company | EPS | PE Ratio | RoNW % | NAV | Income |

| Alpha Metallurgical Resources, Inc | 1,233.78 | 14.87 | 11.48% | 11,182.10 | 25,320.27 Cr. |

| Warrior Met Coal, Inc. | 410.12 | 19.44 | 12.82% | 3,423.71 | 13,058.93 Cr. |

IPO Lead Managers aka Merchant Bankers

- IDBI Capital Markets Services Ltd.

- ICICI Securities Ltd.

Company Address

Bharat Coking Coal Limited.

Koyla Bhawan, Koyla Nagar,

Dhanbad Jharkhand,

India – 826005

Phone: 0326-2230190

Email: cos.bccl@coalindia.in

Website: https://bcclweb.in/

IPO Registrar

Kfin Technologies Ltd.

Phone: 04067162222, 04079611000

Email: bccl.ipo@kfintech.com

Website: https://ipostatus.kfintech.com/

BCCL IPO FAQs

What is Bharat Coking Coal (BCCL) IPO?

When Bharat Coking Coal IPO will open for subscription?

What is Bharat Coking Coal IPO Investors Portion?

How to Apply the Bharat Coking Coal IPO?

What is Bharat Coking Coal IPO Issue Size?

What is Bharat Coking Coal IPO Price Band?

What is Bharat Coking Coal IPO Lot Size?

What is the Bharat Coking Coal IPO Allotment Date?

What is the Bharat Coking Coal IPO Listing Date?

Note: The Bharat Coking Coal IPO price band and date are officially announced. The (Bharat Coking Coal IPO grey market premium) will be added to the IPO GMP page as it will start).

14 Responses

Hi Aman,

Its fine. You can go ahead.

SHAREHOLDER QUOTA IS HOW MUCH % ?

Hi Amit,

Its 10%

Nahi mere dost,aap shni and share holder dono me apply kar sakte ho

You can apply in both quato as a share holder and hni or shareholder and retail.but doesn’t apply as a retail and hni quato if you are a share holder

Can we apply in shareholder quota+SHNI category or only shareholder+retail category (less than 2 lakh ) is allowed

Hi Ravi,

You can apply in Share Holder + SHNI Category. Share Holder + Retail is possible.

share holder form send

Bharat coal price range issue price range 21-23 can i apply for 21/- and how the price range pick in IPO case?

Hi Aruna,

You can apply the IPO at Rs. 21. The allotment will be according to the bid range in case of under subscription. If the IPO subscribed heavily, the bid of higher price will be selected and your application will be rejected.

Should apply in this ipo?

Hi Raj,

According the the market speculations we can expect the IPO to give a short term return around 30-40% as expected.

ANY CATEGORY FOR COAL INDIA SHARE HOLDERS

Coal India share holders can apply in Retail and Share Holder cateogry both.