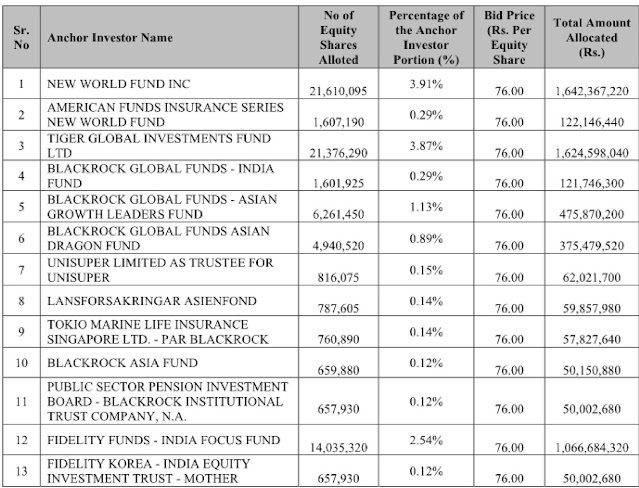

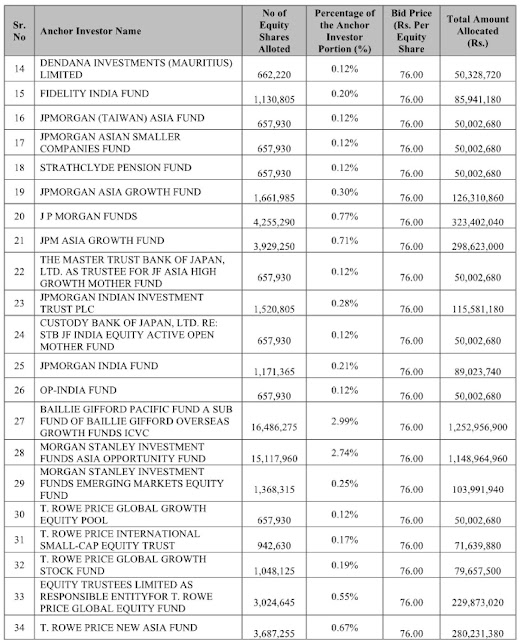

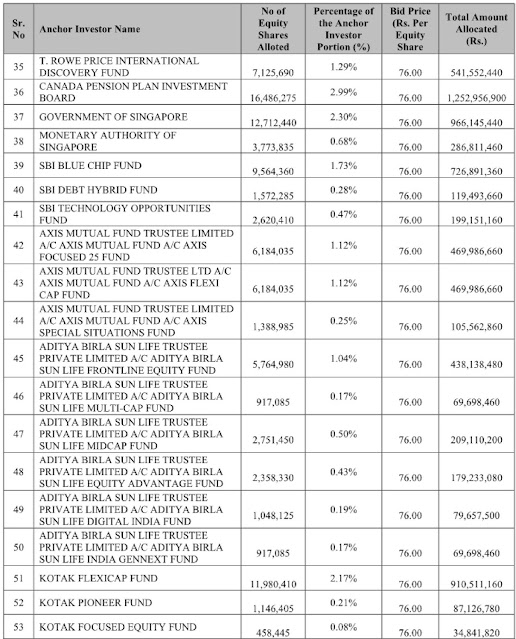

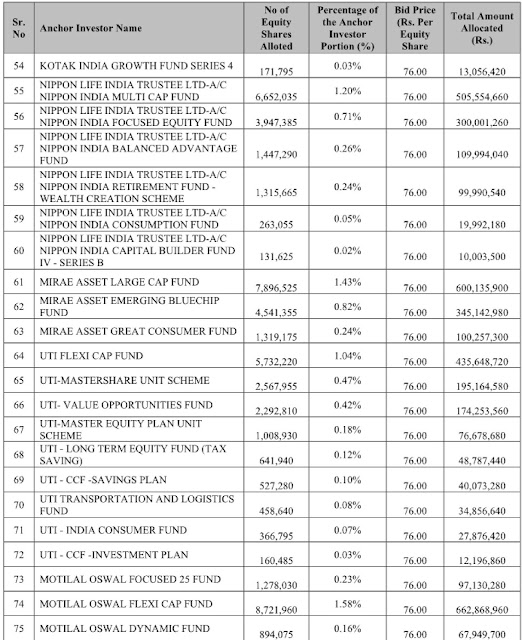

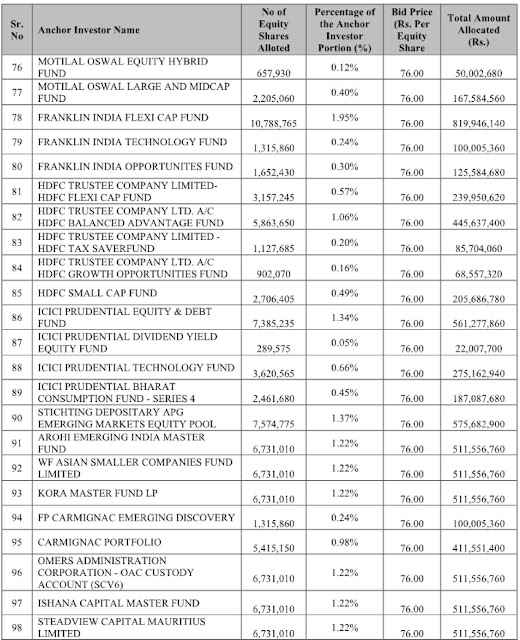

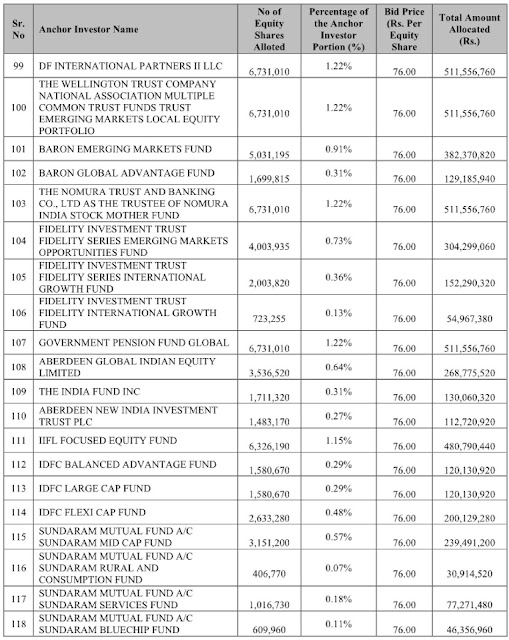

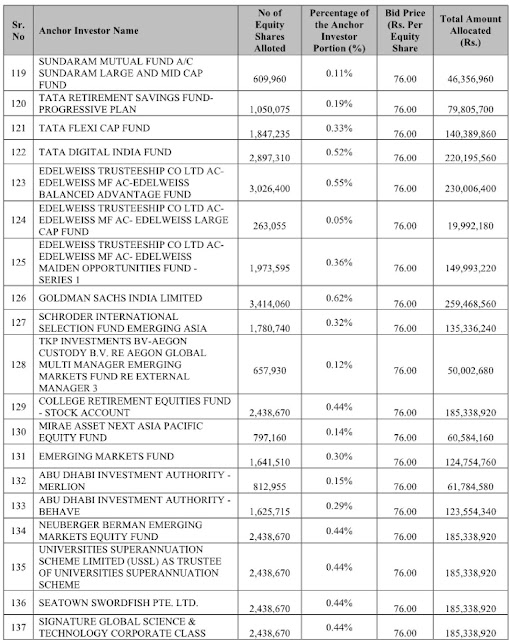

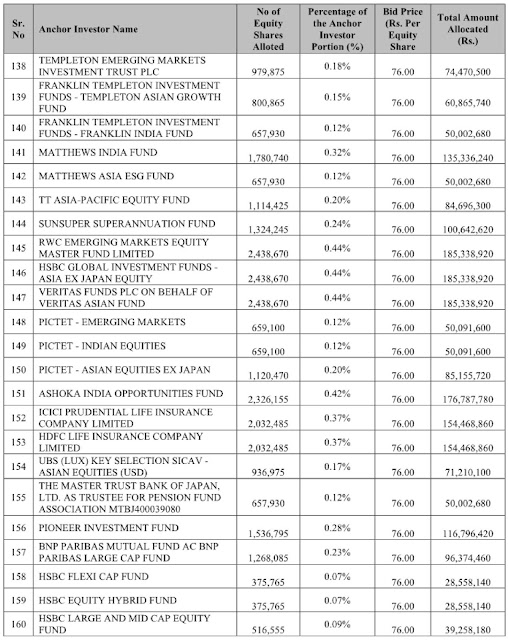

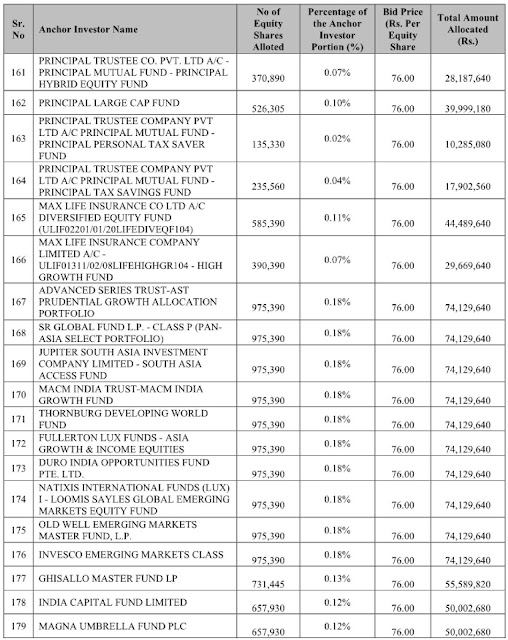

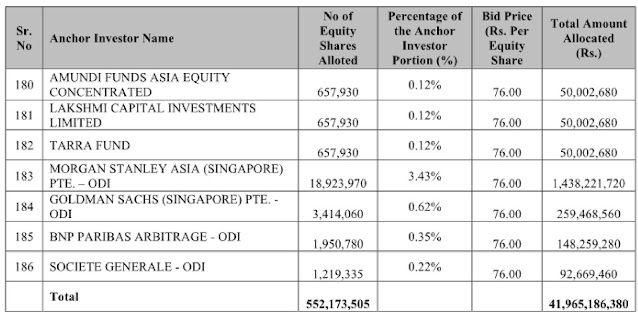

Zomato IPO allotted ₹4,196.51 crore worth of equity shares at ₹76 per equity share to 186 anchor investors at upper price band. Total of 55,21,73,505 Equity Shares have been subscribed at ₹76 per Equity Share. Its a superb subscription from the Anchor Investors in Zomato IPO. The Zomato IPO to open on 14 July and closes on 1 July 2021. The price band is fixed at ₹72-76. The minimum bid is for 195 Shares (₹14,820) and maximum bid is 2535 shares (₹192,660). Zomato IPO to raise ₹9375 Crores via initial public offer. As per the market conditions and the investors mood we will get good subscription for Zomato IPO.

List of Zomato Anchor Investors:

Check the BSE Notice: Click Here

The Bid/Offer Closing Date is on July 16, 2021. The Price Band for the Offer is from ₹72 to ₹76 per Equity Share. The Bids can be made for a minimum lot of 195 Equity Shares and in multiples of 195 Equity Shares thereafter. The Equity Shares are proposed to be listed on BSE and NSE (the “Stock Exchanges”).

The Book Running Lead Managers of the IPO are Kotak Mahindra Capital Company Limited, Morgan Stanley India Company Private Limited, Credit Suisse Securities (India) Private Limited, BofA Securities India Limited and Citigroup Global Markets India Private Limited.