Rolex Rings IPO allotted ₹219.3 crore worth of equity shares at ₹900 per equity share to 26 anchor investors at upper price band. Total of 24,36,666 Equity Shares have been subscribed at ₹900 per Equity Share. It was nice start for an IPO before subscription starts. We will surely see this impact in the GMP and the Subscription numbers. The Rolex Rings IPO to open on 28 July and closes on 30 July 2021. The price band is fixed at ₹695 to ₹720. The minimum bid is for 16 Shares (₹14,440) and maximum bid is 208 shares (₹187,200). Rolex Rings IPO to raise ₹731 Crores via initial public offer. The things are looking more positive for the IPO.

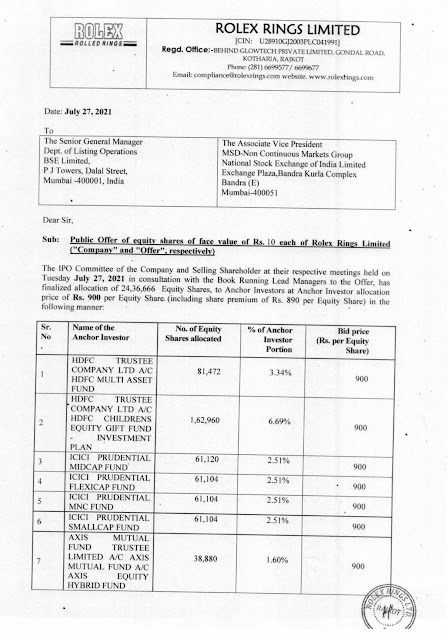

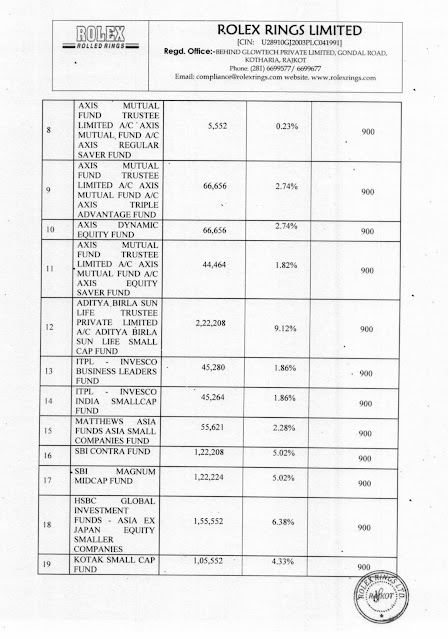

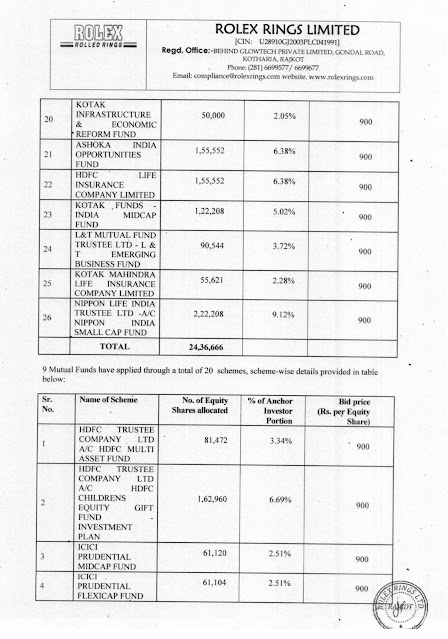

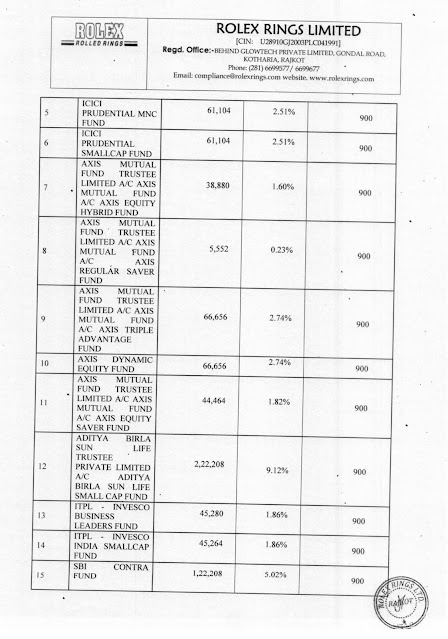

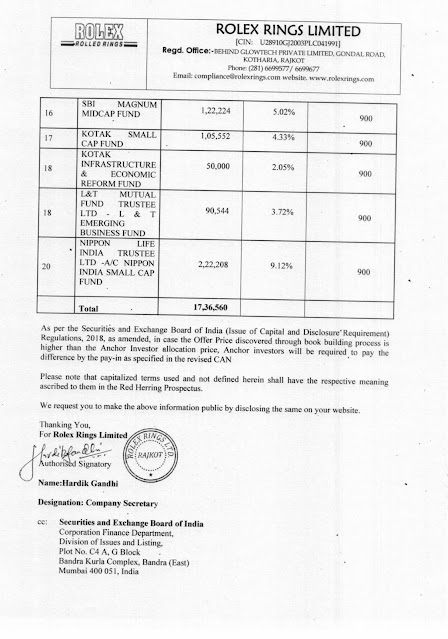

List of Rolex Rings Anchor Investors:

Source: BSEIndia

The Bid/Offer Closing Date is on July 28, 2021. The Price Band for the Offer is from ₹880 to ₹900 per Equity Share. The Bids can be made for a minimum lot of 16 Equity Shares and in multiples of 16 Equity Shares thereafter. The Equity Shares are proposed to be listed on BSE and NSE (the “Stock Exchanges”).

The Book Running Lead Managers of the IPO are Equirus Capital Private Limited, IDBI Capital Market Services Limited and JM Financial Consultants Private Limited.