Phytochem Remedies IPO Details

Phytochem Remedies IPO Review & Key Points

- Review: Neutral

- Rating: 2

Phytochem Remedies IPO Market Lot

The Phytochem Remedies IPO minimum market lot is 2,400 shares with ₹2,35,200 application amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 2 | 2,400 | ₹2,35,200 |

| Retail Maximum | 2 | 2,400 | ₹2,35,200 |

| S-HNI Minimum | 3 | 3,600 | ₹3,52,800 |

IPO Reservation

| Investor Category | Share Offered | -% Shares |

| Anchor Investor | – Shares | -% |

| QIB (Ex. Anchor) | – Shares | -% |

| NII Shares Offered | 18,51,600 Shares | 47.48% |

| Retail Shares Offered | 18,51,600 Shares | 47.48% |

Phytochem Remedies IPO Dates

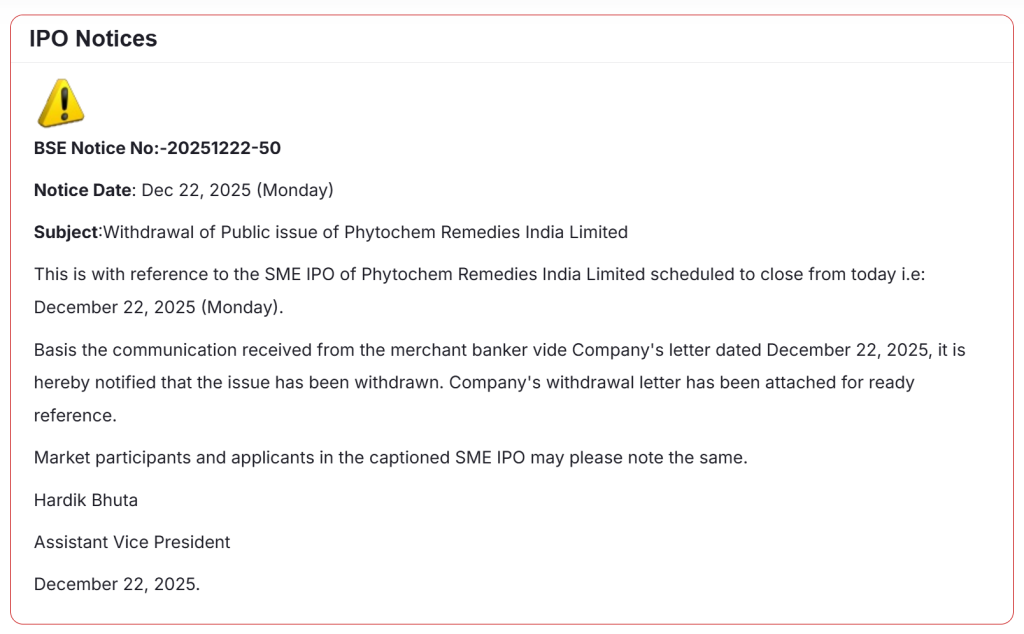

The Phytochem Remedies IPO date is December 18 and the close date is December 22. The Phytochem Remedies IPO allotment will be finalized on December 23 and the IPO listing on December 26.

| IPO Open Date: | December 18, 2025 |

| IPO Close Date: | December 22, 2025 |

| Basis of Allotment: | December 23, 2025 |

| Refunds: | December 24, 2025 |

| Credit to Demat Account: | December 24, 2025 |

| IPO Listing Date: | December 26, 2025 |

| IPO Bidding Cut-off Time: | December 22, 2025 – 5 PM |

Promoters and Holding Pattern

The promoters of the company are Aditi Bohra, Bohra Agrifilms Private Limited, Niranjan Surana and Shilpa Surana.

| Particular | Shares | % Share |

| Promoter Holding Pre Issue | 78,75,000 | 100.00% |

| Promoter Holding Post Issue | 1,17,75,000 | 66.88% |

Objects of the Issue & Utilisation of proceeds

| Purpose | Crores |

| Funding capital expenditure requirements for the purchase of equipment/machineries | ₹13.60 |

| Funding capital expenditure requirements towards civil construction | ₹5.88 |

| Repayment/pre-payment, in full or in part, of certain borrowings availed by the Company | ₹9.37 |

| General Corporate Purpose | ₹5.64 |

About Phytochem Remedies IPO

Since its incorporation in 2002, Phytochem Remedies Limited has been involved in the manufacturing of corrugated boxes and corrugated boards. The type of material used for packing, storage, and transportation is due to its lightweight, strong, and cost-effective nature. The company serves its solutions to the food & beverages, FMCG, pesticides, pharmaceuticals, and automotive industries.

The company includes 51 employees as of September 2025. Moreover, the company operates 2 manufacturing units situated at Bari Brahmana, Jammu. Unit 1 covers 43,360 sq. ft and Unit 2 covers 1,73,440 sq. ft. Its product portfolio consists of a wide range of products such as Corrugated Boxes (3-Ply, 5-Ply, & 7-Ply), Printed Corrugated Boxes, Corrugated Rolls, and Corrugated Pads and Sheets.

Phytochem Remedies IPO Company Financial Report

Amount ₹ in Crores

| Period Ended | Revenue | Expense | PAT | Assets |

| 2023 | ₹20.83 | ₹19.68 | ₹0.82 | ₹37.07 |

| 2024 | ₹32.90 | ₹29.76 | ₹2.31 | ₹41.85 |

| 2025 | ₹36.81 | ₹30.75 | ₹4.48 | ₹44.50 |

| September 2025 | ₹25.01 | ₹19.81 | ₹3.75 | ₹53.68 |

Phytochem Remedies IPO Valuation – FY2025

Check Phytochem Remedies IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| KPI | Values |

| ROE: | 34.07% |

| ROCE: | 25.29% |

| EBITDA Margin: | 23.78% |

| PAT Margin: | 12.25% |

| Debt to equity ratio: | 1.42 |

| Earning Per Share (EPS): | ₹14.21 (Basic) |

| Price/Earning P/E Ratio: | 6.90 |

| Return on Net Worth (RoNW): | 34.07% |

| Net Asset Value (NAV): | ₹41.71 |

Peer Group Comparison

| Company | EPS | PE Ratio | RoNW % | NAV | Income |

| Perfectpac Ltd | 4.73 | 20.49 | 8.40% | 56.36 | 113.46 Cr. |

| Worth Peripherals Ltd | 10.03 | 14.43 | 9.10% | 110.28 | 194.71 Cr. |

| G K P Printing & Packaging Ltd | 0.39 | 18.36 | 3.80% | 10.18 | 30.12 Cr. |

IPO Lead Managers aka Merchant Bankers

- Mefcom Capital Markets Ltd.

Company Address

Phytochem Remedies India Limited

220, Ashok Nagar Main Road, Udaipur City,

Udaipur, Girwa, Rajasthan, India, 313001

Phone: +91 294 4577549

E-mail: [email protected]

Website: http://www.phytochem.co.in/

IPO Registrar

Bigshare Services Pvt.Ltd.

Phone: +91-22-6263 8200

Email: [email protected]

Website: https://ipo.bigshareonline.com/IPO_Status.html

Phytochem Remedies IPO FAQs

What is Phytochem Remedies IPO?

When Phytochem Remedies IPO will open for subscription?

What is Phytochem Remedies IPO Investors Portion?

How to Apply the Phytochem Remedies IPO?

What is Phytochem Remedies IPO Issue Size?

What is Phytochem Remedies IPO Price Band?

What is Phytochem Remedies IPO Lot Size?

What is the Phytochem Remedies IPO Allotment Date?

What is the Phytochem Remedies IPO Listing Date?

Note: The Phytochem Remedies IPO price band and date are officially announced. The (Phytochem Remedies IPO grey market premium) will be added to the IPO GMP page as it will start).