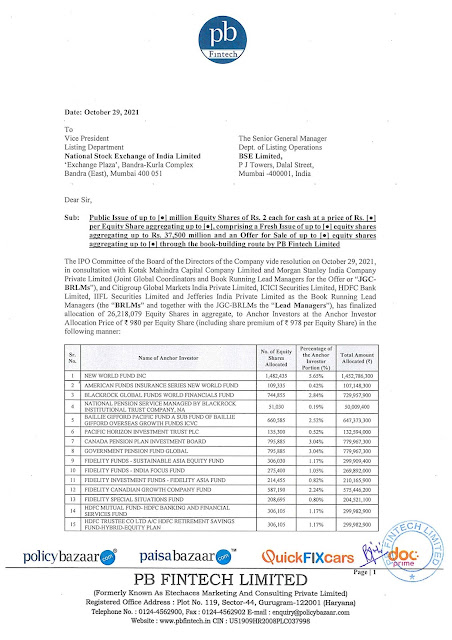

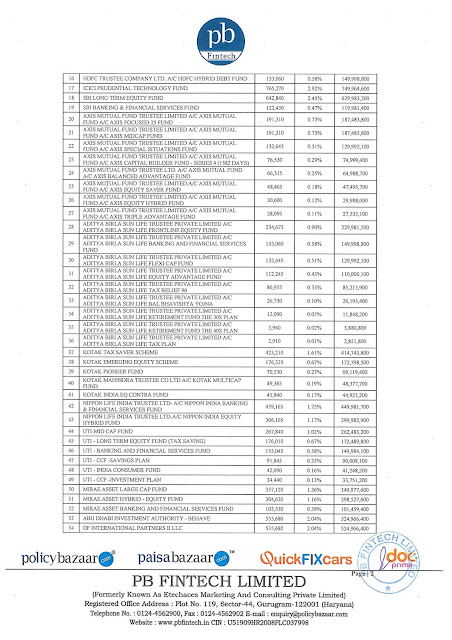

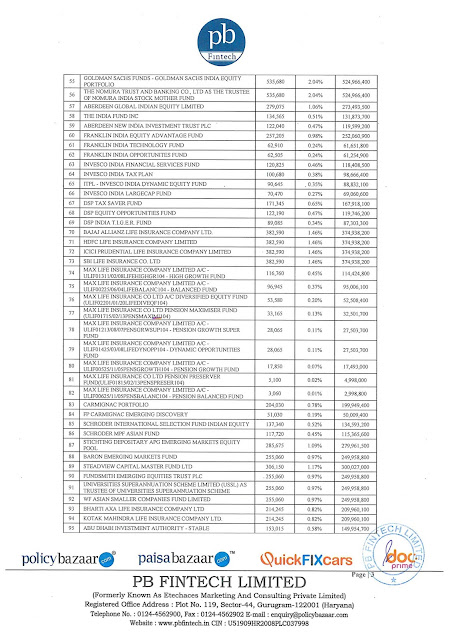

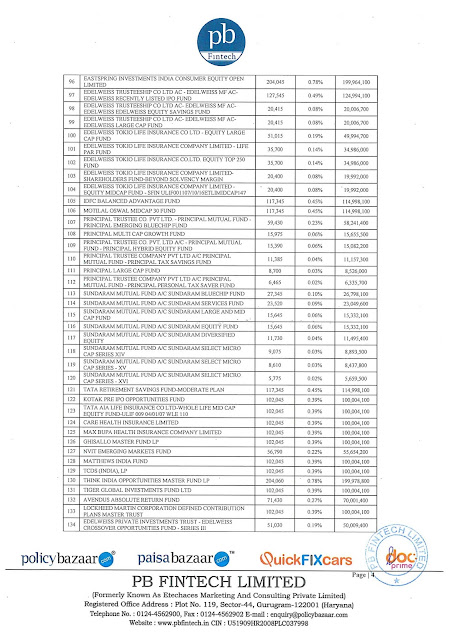

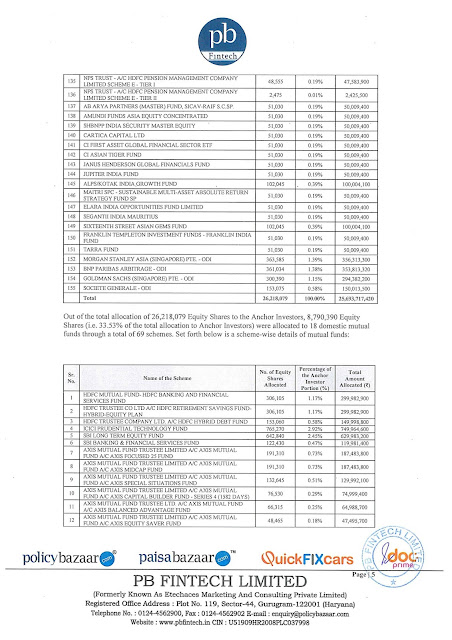

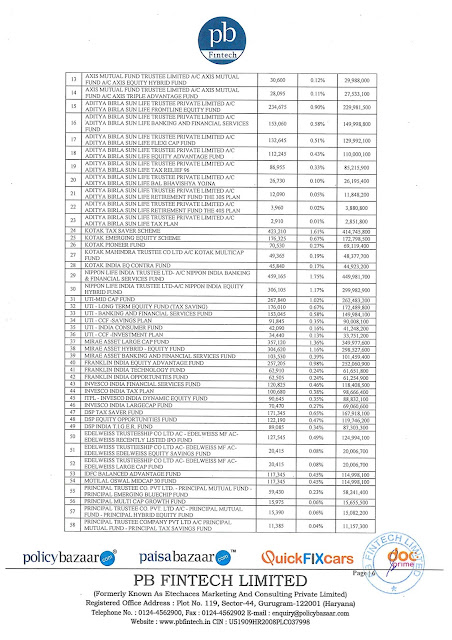

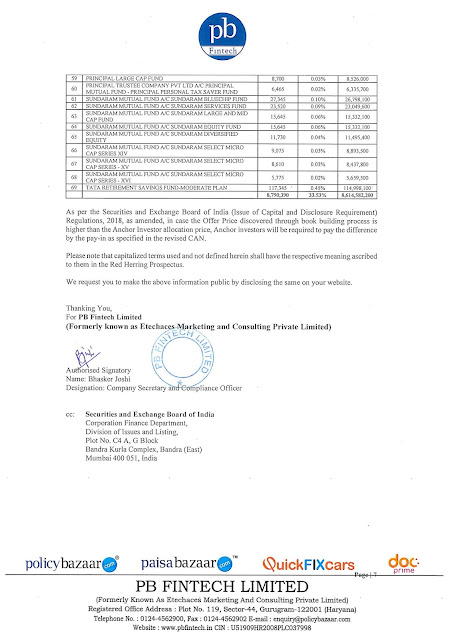

A Haryana based one of the largest largest online insurance platform, PB Fintech aka Policybazaar raised ₹2569 crore from anchor investors on October 29, 2021 Friday before the IPO. The PB Fintech aka Policybazaar IPO to open on November 01, Monday. The company allotted total of 26,218,079 equity shares to 155 Anchor investors at a upper price band ₹980. The anchor investors list includes 18 Mutual Funds through a total of 69 schemes. The company is going to raise ₹6017 crores via IPO. Check out the final list of PB Fintech aka Policybazaar Anchor Investors given below:

List of PB Fintech aka Policybazaar Anchor Investors:

The IPO Committee of the Board of the Directors of the Company vide resolution on October 29, 2021, in consultation with Kotak Mahindra Capital Company Limited and Morgan Stanley India Company Private Limited (Joint Global Coordinators and Book Running Lead Managers for the Offer or “JGC-BRLMs”), and Citigroup Global Markets India Private Limited, ICICI Securities Limited, HDFC Bank Limited, IIFL Securities Limited and Jefferies India Private Limited as the book running lead managers (the “BRLMs” and together with the JGC-BRLMs the “Lead Managers”). has finalized allocation of 26,218,079 Equity Shares in aggregate, to Anchor Investors at the Anchor Investor Allocation Price of ₹980 per Equity Share (including share premium of ₹978 per Equity Share). The details are given below: