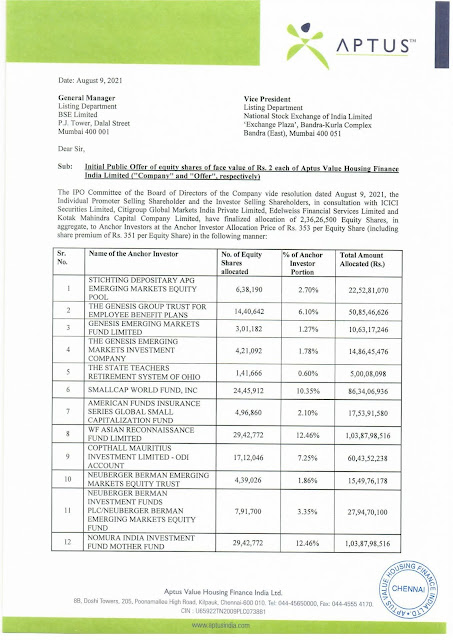

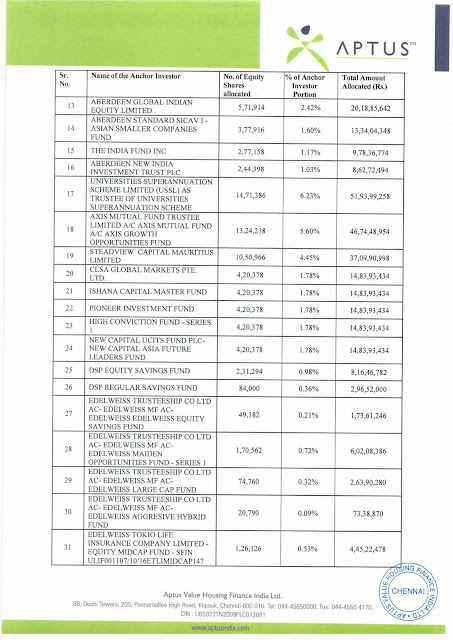

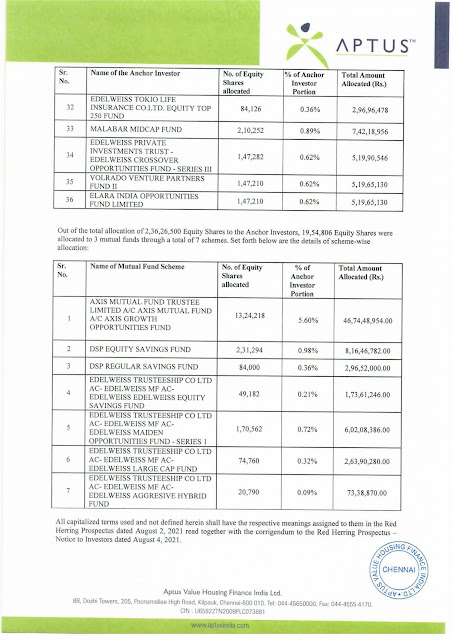

A South India based housing finance company Aptus Value Housing Finance raised ₹834 crore from anchor investors on August 09, 2021 Monday before the IPO. The Aptus Value Housing Finance IPO to open on Tuesday. The company allotted total of 2,36,26,500 equity shares to 36 anchor investors at a upper price band ₹353. The anchor investors list includes 3 Mutual Funds . The company is going to raise ₹2780 crores via IPO that comprises ₹500 crores fresh issue and ₹2280 crore offer for share. Check out the final list of Aptus Value Housing Finance Anchor Investors given below:

List of Aptus Value Housing Finance Anchor Investors:

The IPO Committee of the Board of Directors of the Company vide dated August 9, 2021, the Individual Promoter Selling Shareholder and the Investor Selling Shareholders, in consultation with ICICI Securities Limited, City Group Global Markets India Private Limited, Edelweiss Financial Services Limited and Kotak Mahindra Capital Company Limited, have finalized allocation of 2,36,26,500 Equity Shares, in aggregate, to Anchor Investors at Anchor Investor allocation price of ₹353 per Equity Share (including share premium of ₹351 per Equity Share). in the following manner. The details are given below: