Mankind Pharma is one of the largest Indian multinational pharmaceutical companies. Incorporated in 1991, They are India’s fourth largest pharmaceutical company in terms of domestic sales and are engaged in developing, manufacturing, and marketing a diverse range of pharmaceutical formulations across various acute and chronic therapeutic areas, as well as several consumer healthcare products.

Mankind Pharma manufacturers of condoms (Manforce), pregnancy test kits (Prega News), and emergency contraceptive brand Unwanted – 72. Their brands are Manforce Condoms, Prega News, and Gas O Fast Sachets. The company is headquartered in Delhi and serves worldwide with its branded products.

Anchor Investors: Mankind Pharma raises Rs 1,297 crore from anchor investors ahead of IPO. Goldman Sachs, Blackrock, CPPIB, domestic MFs among anchor investors.

Objects of the Issue

- Utilisation of the Offer Proceeds.

- Offer Related Expenses.

Mankind Pharma IPO Review (Apply or Not)

- Apply with Long Term Views

Brokerage Firm IPO Review

- Centrum Wealth Management: Apply

- Geojit Securities: Apply

- ICICI Direct: Apply

Mankind Pharma IPO Date & Price Band Details

| IPO Open: | April 25, 2023 |

| IPO Close: | April 27, 2023 |

| IPO Size: | Approx ₹4326 Crores |

| Offer for Sale: | Approx ₹4326 Crores |

| Face Value: | ₹1 Per Equity Share |

| IPO Price Band: | ₹1026 to ₹1080 Per Share |

| IPO Listing on: | BSE & NSE |

| Retail Quota: | 35% |

| QIB Quota: | 50% |

| NII Quota: | 15% |

| Discount: | N/A |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors List: | Click Here |

Mankind Pharma IPO Market Lot

The Mankind Pharma IPO minimum market lot is 13 shares with ₹14,040 application amount. The retail investors can apply up-to 14 lots with 185 shares or ₹196,560 amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 13 | ₹14,040 |

| Retail Maximum | 14 | 182 | ₹196,560 |

| S-HNI Minimum | 15 | 195 | ₹210,600 |

| B-HNI Minimum | 72 | 936 | ₹10,10,880 |

Mankind Pharma IPO Allotment & Listing Dates

The Mankind Pharma IPO date is April 25 and the close date is April 27. The Mankind Pharma IPO allotment will be finalized on May 3 and the IPO listing on May 9.

| Price Band Announcement: | April 19, 2023 |

| Anchor Investors Allotment: | April 24, 2023 |

| IPO Open Date: | April 25, 2023 |

| IPO Close Date: | April 27, 2023 |

| Basis of Allotment: | May 3, 2023 |

| Refunds: | May 4, 2023 |

| Credit to Demat Account: | May 8, 2023 |

| Mankind Pharma IPO Listing Date: | May 9, 2023 |

You can check IPO subscription status and IPO allotment status on their respective pages.

Mankind Pharma IPO Form

How to apply for the Mankind Pharma IPO? You can apply for Mankind Pharma IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Mankind Pharma IPO in the Invest section. The other option is you can apply for Mankind Pharma IPO via IPO forms downloaded via NSE and BSE. Check out the Mankind Pharma forms – Click BSE Forms & NSE Forms blank IPO forms download, fill, and submit in your bank or with your broker.

Mankind Pharma Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2020 | ₹5976 | ₹4549 | ₹1056 |

| 2021 | ₹6385 | ₹4705 | ₹1293 |

| 2022 | ₹7978 | ₹6017 | ₹1453 |

Mankind Pharma IPO Valuation – FY2022

Check Mankind Pharma IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| Earning Per Share (EPS): | ₹35.78 per Equity Share |

| Price/Earning P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 23.2% |

| Net Asset Value (NAV): | ₹153.6 per Equity Share |

Peer Group

- Sun Pharmaceuticals Industries Limited

- Cipla Limited

- Zydus Lifesciences Limited

- Torrent Pharmaceutical Limited

- Alkem Laboratories

- JB Chemicals & Pharmaceuticals Limited

- Eris Lifesciences Limited

- Ipca Laboratories Limited

- Abbott India Limited

- Glaxosmithkline Pharmaceuticals Limited

- Dabur India Limited

- Procter & Gamble Health Limited

- Zydus Wellness Limited

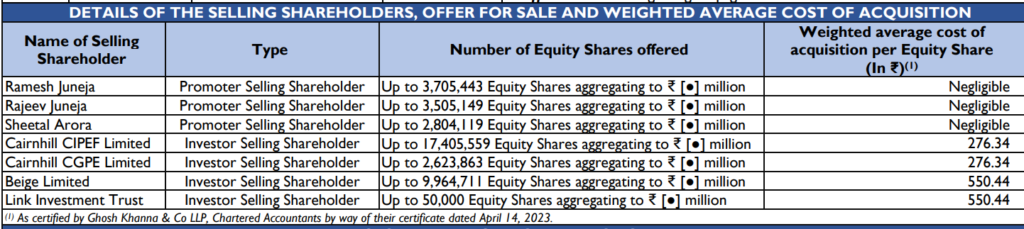

Company Promoters

- Ramesh Juneja

- Rajeev Juneja

- Sheetal Arora

- Ramesh Juneja Family Trust

- Rajeev Juneja Family Trust

- Prem Sheetal Family Trust

Mankind Pharma IPO Registrar

KFin Technologies Limited

Tel:+91 40 6716 2222

E-mail: [email protected]

Website:www.kfintech.com

Mankind Pharma IPO Allotment Status Check

Check Mankind Pharma IPO allotment status on KFintech website allotment URL. Click Here

Mankind Pharma IPO Lead Managers aka Merchant Bankers

- Kotak Mahindra Capital Company Limited

- Axis Capital Limited

- IIFL Securities Limited

- Jefferies India Private Limited

- J.P. Morgan India Private Limited

Company Address

Mankind Pharma Limited

208, Okhla Industrial Estate,

Phase-III, New Delhi 110 020,

Tel:+91 11 4747 6600

E-mail: [email protected]

Website:www.mankindpharma.com

Mankind Pharma IPO FAQs

What is Mankind Pharma IPO?

When Mankind Pharma IPO will open?

What is Mankind Pharma IPO Investors Portion?

How to Apply the Mankind Pharma IPO?

How to Apply the Mankind Pharma IPO through Zerodha?

How to Apply the Mankind Pharma IPO through Upstox?

How to Apply the Mankind Pharma IPO through Paytm Money?

What is Mankind Pharma IPO Size?

What is Mankind Pharma IPO Price Band?

What is Mankind Pharma IPO Minimum and Maximum Lot Size?

What is the Mankind Pharma IPO Allotment Date?

What is the Mankind Pharma IPO Listing Date?

Note: The Mankind Pharma IPO price band and date are officially announced. The IPO grey market premium (Mankind Pharma IPO Premium) will be added to the IPO grey market page as it will start).

Follow IPO Watch for the Upcoming IPO news and their reviews, also keep following us on Twitter, Facebook, and Instagram. For our latest videos, subscribe to our YouTube channel.

2 Responses

Is the Mankind Pharma IPO good to apply?

Looks Good, Lets hope for the best.