The distribution of these shares includes a particular portion allocated to various stakeholders: Kandula Krishna Veni and Kandula Ramakrishna will offer up to 4.13 million shares and 4.90 million shares, respectively; M/s S2 Engineering Services will sell up to 5.20 million shares. Other important sellers include Katragadda Venkata Ramani with up to 500,000 shares, M/s Standard Holdings with up to 504,000 shares, and Nageswara Rao Kandula with up to 765,000 shares. Apart from that, Katragadda Harini, Venkata Siva Prasad Katragadda, and Mahitha Katragadda will each sell up to 350,000 shares, while Venkata Sandeep Gopineedi will offer up to 450,000 shares.

Standard Glass Lining Technology Ltd. is headquartered in Hyderabad. The company plans to raise significant funds through this public offering to support its growth and operational requirements. It specializes in the production of glass-lined, stainless steel, and high-alloy-based specialized engineering equipment suppliers of polytetrafluoroethylene (“PTFE”)-lined pipelines and fittings.

Proceeds from the new issue will be strategically allocated as follows: ₹130 crore will be used to pay off outstanding debt, and an additional ₹130 crore will be invested in the entirely owned subsidiary S2 Engineering Industry Private Ltd. for similar debt repayment plans. Thirty crore rupees will be set aside for spending on capital for the subsidiary, and thirty crore rupees will be set aside for general corporate purposes. ₹10 crore will be used for capital expenses to buy new machinery and equipment, and ₹20 crore will be set aside for financing inorganic growth through possible deals or strategic investments.

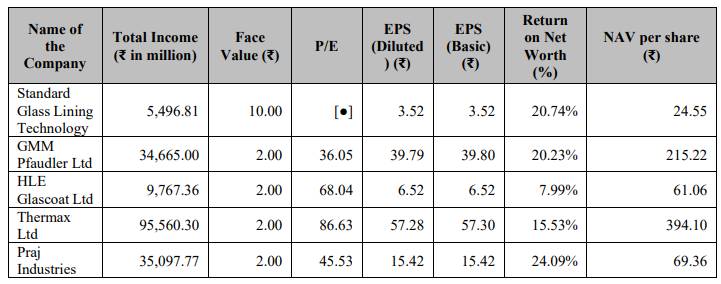

Standard Glass Lining Technologies reported a 9.26% increase in revenue from operations, rising from ₹497.59 crore in financial year 2023 to ₹543.67 crore in FY2024. This growth was primarily driven by an increase in overall product sales, higher prices for products, enhanced service, and comprehensive maintenance contract sales. Additionally, profit after taxes rose from ₹53.42 crore in FY2023 to ₹60.01 crore in FY2024.

The offer’s registrar is KFin Technologies Limited, and the book-running lead managers of the IPO are Motilal Oswal Investment Advisors Limited and IIFL Securities Limited. The company is planning to sell its shares on the BSE and NSE.

As Standard Glass Lining Technology prepares to go public, the upcoming IPO will generate significant investor interest, reflecting the company’s strong market position and growth trajectory in the specialized engineering sector.