The promoters of the Company are Rajendra Kumar Setia, Yash Setia, and Rajendra Kumar Setia HUF. The registrar of the IPO is KFin Technologies Limited. The book-running lead managers of the SK Finance Limited IPO are Kotak Mahindra Capital Company, Jefferies India, Motilal Oswal Investment Advisors, and Nomura Financial Advisory and Securities (India).

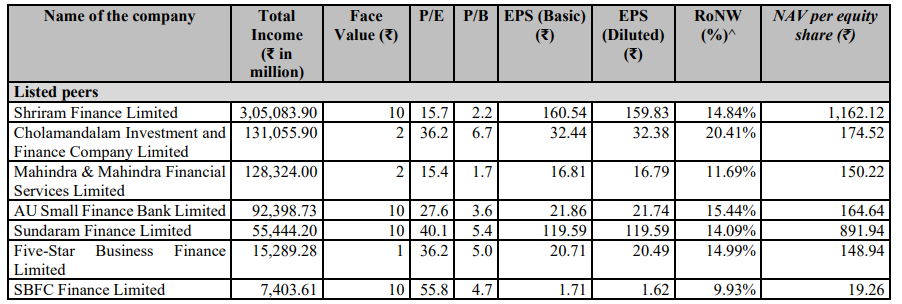

The company reported revenue of ₹13,142.41 million in 2023 against revenues of ₹8,206.87 million in 2022. The PAT was ₹2,227.86 million in 2023 against ₹1,428.74 million in 2022. The peer groups of the company are Shriram Finance Limited, Cholamandalam Investment and Finance Company Limited, Mahindra & Mahindra Financial Services Limited, AU Small Finance Bank Limited, Sundaram Finance Limited, Five-Star Business Finance Limited, and SBFC Finance Limited

SK Finance Limited is a non-deposit-taking non-banking finance company middle layer (NBFC ML) that operates in two main areas: vehicle financing and Micro, Small, and Medium Enterprises (MSME) financing. The company has a wide distribution network in rural areas, to provide financial support to unbanked customers and ensure last-mile coverage.

With over 25 years of experience, the business has developed a robust underwriting process based on three core principles: insurance, intent, and income. The primary focus of the company’s first principle, income, is to lend to clients’ businesses that generate revenue. This streamlines the lending decision-making process by emphasizing the value of the collateral and the client’s ability to generate income.