A pharmaceutical company, Senores Pharmaceuticals, has filed its draft papers with the Securities and Exchange Board of India (SEBI) to launch its initial public offering (IPO). The company is headquartered in Ahmedabad.

This upcoming IPO contains fresh issues as well as an offer-for-sale. It includes Rs 500 crore as fresh equity shares, and existing shareholders are selling 27 lakh equity shares as an offer-for-sale (OFS).

Right now, Senores Pharma’s promoters account for 66.67% of the company’s shares, and public shareholders have the remaining shares. In the Offer-For-Sale (OFS), promoters Sangeeta Mukur Barot, Ashokkumar Vijaysinh Barot, and Swapnil Jatinbhai Shah will sell 17 lakh shares. Additionally, Prakash M. Sanghvi, another key shareholder, plans to sell 10 lakh shares.

Before filling RHP, Senores Pharma is planning a Rs 100 crore pre-IPO placement to make a strong financial position, which could potentially reduce the size of the fresh issue. The money raised from the IPO will be used to pay for several important projects. It includes working capital requirements, establishing a sterile injection manufacturing facility in Atlanta, and inorganic growth. The company also plans to pay down its debt with a portion of the proceeds from the IPO.

At the end of 2024, Senores Pharma had successfully launched 21 products on the US and Canadian markets and had been approved for 19 abbreviated new drug applications (ANDAs). With six ANDAs filed, six products undergoing stability testing, three products nearing exhibit readiness, and two ongoing exhibits, the company is steadily growing its range of products.

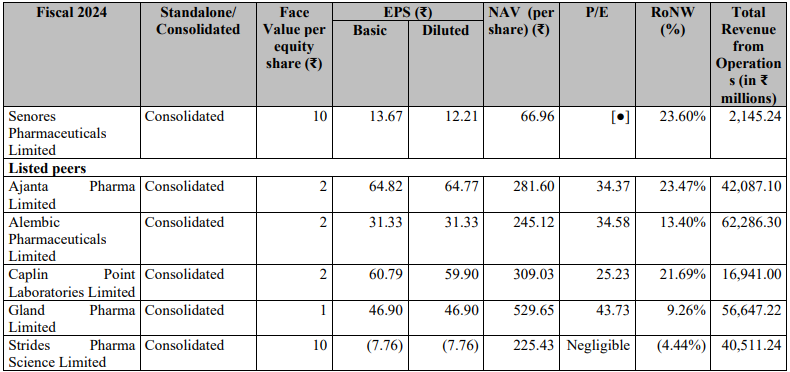

In terms of finance, Senores Pharma reported a notable four-fold increase in net profit, which increased from Rs 8.4 crore to Rs 32.7 crore for the fiscal year ending in March 2024. This growth is caused by strong revenue streams and tax write-backs, even though operating margins are lower due to higher input costs. The revenue increased six times to Rs 214.5 crore in FY24 from Rs 35.3 crore in FY23. However, the EBITDA margin fell to 19.4% in FY24 from 35.8% in FY23.

It is difficult to compare the company’s financial performance in FY24 to data from previous years because it includes the effects of acquiring Havix and RPPL.

The lead managers of the IPO are Nuvama Wealth Management, Equirus Capital, and Ambit.

Senores Pharmaceuticals’ strategic move to go public shows the company’s growth direction and commitment to expanding its presence around the world, particularly in developing markets.