Bhavish Aggarwal is the promoter of the company. The registrar of the IPO is Link Intime India Private Limited. Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, BofA Securities India Limited, Goldman Sachs (India) Securities Private Limited, Axis Capital Limited, ICICI Securities Limited, SBI Capital Markets Limited, and BOB Capital Markets Limited are the book-running lead managers for the OLA Electric Mobility Limited IPO.

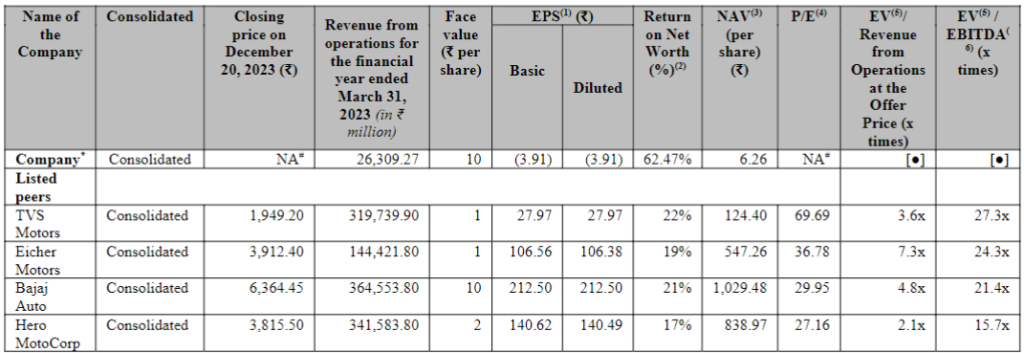

The company reported revenue of ₹27,826.97 million in 2023 against revenue of ₹4,562.60 million in 2022. After recording a ₹7,841.50 million loss in 2022, Ola Electric records a ₹14,720.79 million loss in 2023. The peer group of companies are TVS Motors, Eicher Motors, Bajaj Auto, and Hero MotoCorp.

Ola Electric Mobility Limited is India’s leading pure EV manufacturer, known for its integrated approach to technology and production. At the core of their operations is the Ola Futurefactory, the largest automated E2W manufacturing plant in India. Here, they produce EVs and essential components like battery packs, motors, and vehicle frames. This facility, along with the upcoming Ola Gigafactory and suppliers in Krishnagiri district, Tamil Nadu, positions Ola Electric to take full advantage of India’s shift towards electric mobility.

In fiscal year 2023, Ola Electric led the revenue charts among electric two-wheeler OEMs in India, showcasing their market dominance. Their strategy relies on extensive R&D efforts in India, the UK, and the US, aimed at advancing EV technology and developing crucial components. Complementing their manufacturing strength, Ola Electric has built a robust omnichannel distribution network with 935 experience centers and 414 service centers across India. This network highlights their dedication to providing customers with easy access and comprehensive support in the rapidly evolving electric vehicle market.