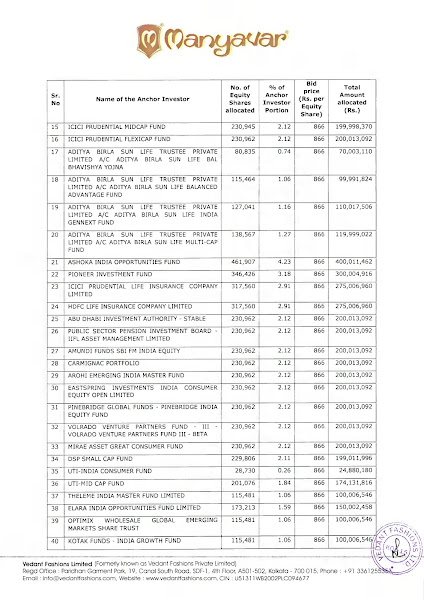

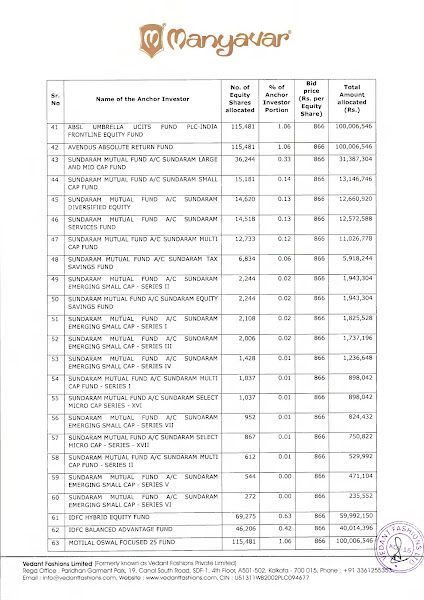

India’s leading wedding wear and owner of Manyawar brand Vedant Fashions raised ₹944.75 crores from anchor investors on February 03, Thursday before the IPO. The Vedant Fashions IPO is to open on February 04, Friday. The company allotted a total of 1,09,09,450 equity shares to 75 Anchor investors at an upper price band of ₹866. The anchor investors list includes 14 Mutual Funds through a total of 44 schemes. The company is going to raise ₹3149 crores. Check out the final list of Vedant Fashions Anchor Investors given below:

Vedant Fashions aka Manyavar Anchor Investors List:

The IPO Committee of the Company at their meeting held on February 03, 2022, in consultation with Axis Capital, Edelweiss Financial Services, ICICI Securities, IIFL Securities and Kotak Mahindra Capital (the “Book Running Lead Managers” or “BRLMs”), have finalized allocation of 1,09,09,450 equity shares, to Anchor Investors at the Anchor Investor Allocation Price of ₹866/- per Equity Share (including share premium of ₹865/- per Equity Share). The details are given below:

Source: BSEIndia

The Vedant Fashions IPO to open on 04 February and close on 08 February 2022. The price band is fixed at ₹824 to ₹866. Vedant Fashions IPO application minimum bid is for 17 Shares (₹14,722) and the maximum bid is 221 shares (₹191,386). The Book Running Lead Managers of the IPO are Axis Capital, Edelweiss Financial Services, ICICI Securities, IIFL Securities and Kotak Mahindra Capital.

Follow IPO Watch for the latest IPO news and their reviews, also keep following us on Twitter, Facebook, and Instagram. For our latest videos, subscribe to our YouTube channel.