UPI (Unified Payments Interface) is a mobile based payment platform which can transfer funds from one bank account to another bank account instantly. It will speed up the process of listing as well. The main concern is the paper work UPI payment option will reduce the same.

UPI Payment Option Benefits:

– Less Chance of Application Errors

– Easy to Use

– Real Time Payment Platform

– Mobile Based Payment Platform

– Speedup the Listing Process

What is UPI?

As its name Unified Payments Interface – a unique 16 digit number generated from your bank which can be used for money transfer or make payment using IMPS. It works 24×7 and its faster than NEFT. NPCI – National Payments Corporation of India is setting up the UPI with support of Reserve Bank of India. UPI Payment will ease for investors without digital wallet, credit or debit cards.

How to get UPI?

You Need:

– Bank A/C

– Mobile number should be linked with bank a/c

– Smart Phone with internet facility

– Debit Card for re-setting MPIN.

Service Activation:

– Download the App for UPI

– Do registration online on the App with a/c details

– Create a virtual ID

– Set MPIN

– 5-7 minutes

What is required for Transaction:

– Smartphone with internet facility

– Registered device only

– Use registered MPIN

– Self Service Mode

Transaction Cost:

– NIL to customer by most Banks

– Customer pays for data charges

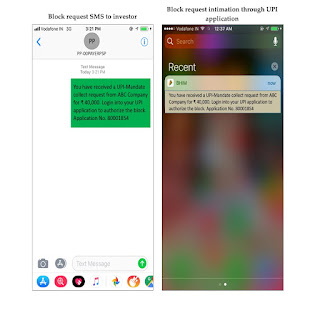

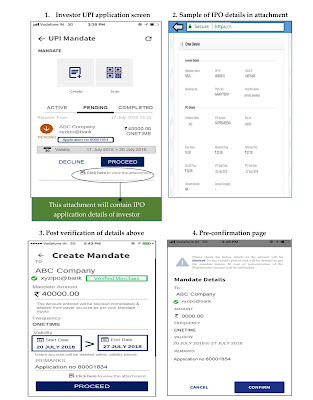

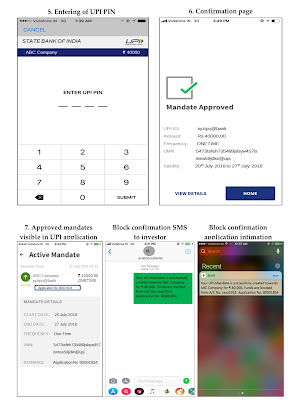

Checkout the official screenshots from SEBI about how to use UPI payments for IPO.

2 Responses

ASBA is customers friendly

No

To UPI

Why link bank with UPI

Trading Account is already link to bank

NICE STEP BY SEBI