Upcoming Mainboard IPOs in 2026

Get the latest Mainboard IPO updates 2026, including current, open, closed, and upcoming IPOs on the NSE and BSE. An Initial Public Offering (IPO) is the process through which a private limited company becomes a publicly listed company by offering its shares on a stock exchange. Mainboard IPOs are listed on both the NSE and BSE as per the schedule mentioned in the Red Herring Prospectus (RHP).

| IPO / Stock | IPO Status | IPO Date | Price Band | Application |

| Bharat Coking Coal (BCCL) | Upcoming | 9-13 Jan 2026 | ₹21 to ₹23 | Apply IPO |

| Clean Max Enviro | Upcoming | 2026 | ₹- | Apply IPO |

| Sunshine Pictures | Upcoming | 2026 | ₹- | – |

| Hero Fincorp | Upcoming | 2026 | ₹- | – |

| Orient Cables | Upcoming | 2026 | ₹- | – |

| Curefoods | Upcoming | 2026 | ₹- | – |

| Hero Motors | Upcoming | 2026 | ₹- | – |

| Priority Jewels | Upcoming | 2026 | ₹- | – |

| Tea Post | Upcoming | 2026 | ₹- | – |

| Clean Max | Upcoming | 2026 | ₹- | – |

| Juniper Green Energy | Upcoming | 2026 | ₹- | – |

| Omnitech Engineering | Upcoming | 2026 | ₹- | – |

Upcoming SME IPOs in 2026

Get the upcoming SME IPO 2026 updates, including current, open, closed, and upcoming IPOs on the NSE Emerge and BSE SME. An Initial Public Offering (IPO) is the process through which a private limited SME company becomes a publicly listed company by offering its shares on a stock exchange. SME IPOs are listed on both the NSE Emerge and BSE SME as per the schedule mentioned in the Red Herring Prospectus (RHP).

| IPO / Stock | IPO Status | IPO Date | Price Band | Application |

| Modern Diagnostic | Closed | 31-2 Jan 2026 | ₹85 to ₹90 | Apply IPO |

| Gabion Technologies | Open | 6-8 Jan 2026 | ₹76 to ₹81 | Apply IPO |

| Yajur Fibres | Open | 7-9 Jan 2026 | ₹168 to ₹174 | Apply IPO |

| Victory Electric Vehicles | Open | 7-9 Jan 2026 | ₹41 | Apply IPO |

| Defrail Technologies | Upcoming | 9-13 Jan 2026 | ₹- | Apply IPO |

| Avana Electrosystems | Upcoming | 12-14 Jan 2026 | ₹56 to ₹59 | Apply IPO |

| Narmadesh Brass | Upcoming | 12-15 Jan 2026 | ₹515 | Apply IPO |

| INDO SMC | Upcoming | 13-15 Jan 2026 | ₹141 to ₹149 | Apply IPO |

| GRE Renew Enertech | Upcoming | 13-16 Jan 2026 | ₹100 to ₹105 | Apply IPO |

| Infraprime Logistics | Upcoming | 2026 | ₹- | – |

| Victory Electric | Upcoming | 2026 | ₹- | – |

Why does IPO matter in 2026?

IPOs in 2026 matter the most to the public and investors like us who are always looking for an opportunity to increase their income, and (IPO) Initial Public Offering come with that opportunity. Many well-known and highly established companies are looking to enter the IPO market in 2026, making the IPO list 2026 one of the most anticipated.

The new IPO 2026 launches will offer investors a great chance to invest in some of the promising companies. As years passed by, the interest of investors in IPOs has increased rapidly, and that’s why we can say that the IPO list 2026 will be the greatest year for IPO, as many big companies are expected to have good listing gains and great opportunities.

Other Notable IPOs to Look for:

- Canva: Another popular platform, used by millions of people all around the world, Canva is also preparing for its IPO. With a valuation of around $26 billion, Canva is expected to make its debut possibly in early 2026.

- Databricks: Databricks, one of the Notable data and artificial intelligence (AI) companies, is looking for favorable market conditions to launch its IPO. As per the report, we can expect the new ipo 2026.

- Plaid: One of the leading financial technology (fintech) companies, Plaid connects apps to your bank account securely. The company’s CEO said that they are definitely thinking of going public; however, not much information has been given by the company yet. Please closely track the upcoming ipo india 2026, as we can expect them to announce their Issue early or mid-2026.

Upcoming IPO in India to Watch

| Company Name | IPO Date | Price Band | IPO Size | DRHP/RHP |

| Reliance Jio | 2026 | TBA | TBA | – |

| PhonePe Ltd | 2026 | TBA | TBA | – |

| boAt | 2026 | TBA | ₹1500 Crore | DRHP |

| Cordelia Cruises | 2026 | TBA | ₹727 crore | DRHP |

| SBI Mutual Fund | 2026 | TBA | TBA | – |

| Hero Fincorp | 2026 | TBA | ₹3,668 crore | DRHP |

| Flipkart | 2026 | TBA | TBA | – |

| Zepto | 2026 | TBA | TBA | – |

| OYO | 2026 | TBA | TBA | – |

| ShadowFax Technologies | 2026 | TBA | TBA | DRHP |

| NSE (National Stock Exchange) | 2026 | TBA | TBA | – |

| Milky Mist | 2026 | TBA | ₹2,035 crore | DRHP |

| Manipal Payment | 2026 | TBA | ₹400 crores | DRHP |

1. Reliance Jio:

We can say that Reliance Jio has been one of the most anticipated IPO of the town right now. Investors are eagerly waiting for this new IPO in 2026 to launch. In fact, at the recent AGM meeting, Mukesh Ambani himself said that Reliance Jio is aiming to file for an IPO by the first half of 2026. If this IPO launches in the next year, it could be the biggest IPO ever.

2. PhonePe Limited:

Another most-awaited new IPO 2026. It is a Walmart-backed company and one of the largest digital payment providers in India. It has already filed a confidential DRHP with SEBI. As per the analyst, PhonePe is targeting to raise around ₹11,000–12,000 crore with a target valuation of around $15 billion.

3. boAt:

One of the leading brands to offer affordable, durable, and fashionable Audio products in India. The company has successfully received the SEBI approval for the launch of its ₹1500 Crore IPO and is ready to make its entry on Dalal Street. This IPO will consist of a fresh issue of ₹500 crore and an Offer for Sale of up to ₹1000 crore. The company is targeting to launch its IPO by FY25-2026.

4. Cordelia Cruise:

It is one of the premium Cruise companies that is known to offer its Indian travelers a luxurious and stylish cruise experience. Since its launch in 2021, the company has welcomed 5,49,051 guests. Cordelia Cruise has filed a DRHP with SEBI to launch its IPO by raising funds of ₹727 crore to add 2 ships. According to the analyst, this IPO will be a completely fresh issue with no OFS component.

5. SBI Mutual Fund:

The upcoming IPO 2026 list can’t be completed without the SBI mutual fund IPO. A joint Venture between the State Bank of India and the French asset management major Amundi, SBI mutual fund IPO targets ₹8000 crore IPO with the filing expected in FY26. With this IPO, investors will be able to take advantage of the country’s rapidly growing mutual fund business.

6. Hero FinCorp:

A Finance company of Hero Motorcorp, Hero FinCorp, is also ready to hit the market with its IPO. The company has already received the SEBI approval for a ₹3,668.13 crore IPO. It is an NBFC company that provides a wide range of loans to individuals. According to the report, this IPO consists of a Fresh Issue of ₹2,100 crore and an Offer-for-Sale of up to ₹1,568.13 crore.

7. Flipkart:

Another big IPO of 2026 can be Flipkart with a valuation of around $36 billion. They are also planning to launch their IPO in early 2026. Currently, the Flipkart company is shifting its headquarters from Singapore to India before going public.

8. Zepto:

Another most-hyped IPO on the 2026 list; investors are eagerly waiting for it. Zepto is one of the growing Indian quick-commerce companies that delivers any grocery and everyday essential goods at the lowest prices within 10 minutes. They are planning to launch their IPO in early 2026. For that, they will first shift their headquarters from Singapore to India. According to the reports, Zepto is planning a big IPO in the range of US$800 million to US$1 billion.

9. OYO:

OYO is one of the leading hospitality platforms in India, and another big upcoming IPO 2026 has also been a talk of the town for a long time now. According to the report, the company has been in discussion with its investment bank for its IPO. The IPO might be launched in early or mid-2026.

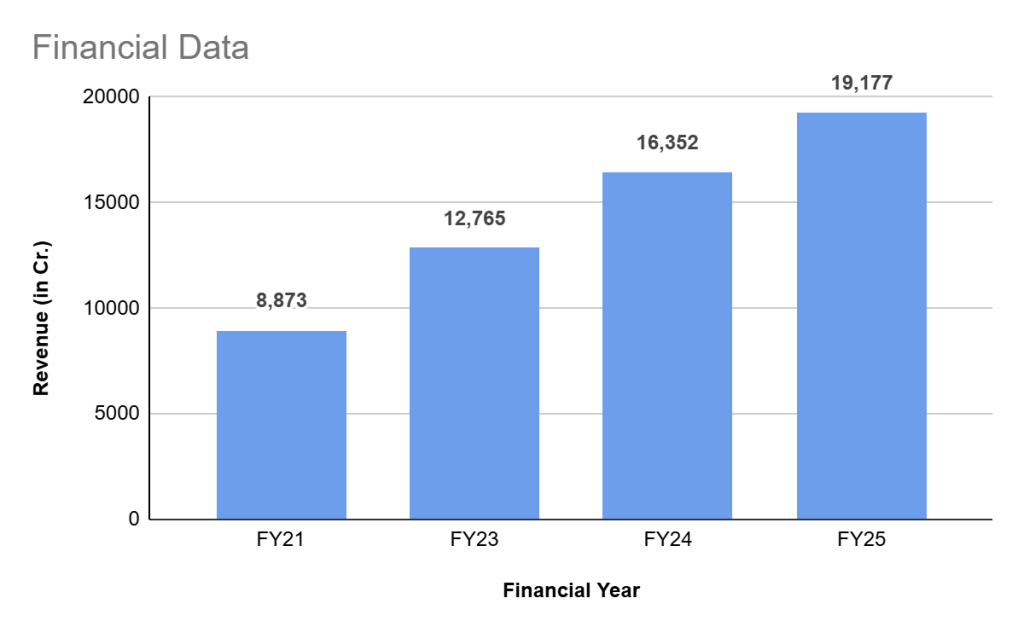

10. ShadowFax Technologies:

Shadowfax, one of the leading logistics companies, is planning to launch its IPO by filing the confidential DRHP with SEBI to raise ₹2000 crore via its IPO. We can expect the company to hit the capital market soon with its new IPO 2026. This IPO consists of a fresh issue and an Offer for Sale component. The company reported revenue of ₹2,514.66 crores in 2025 and reported profit of ₹6.43 crores in 2025.

11. NSE (National Stock Exchange):

India’s largest Stock Exchange, NSE, is also planning to hit Dalal Street with the launch of its IPO. The IPO might be launched by Early or mid-2026. SEBI’s chairman, Tuhin Kanta Pandey, said that there are no remaining obstacles for the launch of NSE IPO, and the company might file the DRHP soon.

12. Milky Mist:

The first private company to launch branded packaged paneer, products like curd, ghee, butter, cheese, yogurt, and ice cream. Miky Mist is also soon tapping the capital market as the company recently received SEBI approval for a ₹2,035 crore IPO. The IPO might be launched in early 2026. This IPO consists of a fresh issue of ₹1,785 crore and an offer-for-sale (OFS) of ₹250 crore.

13. Manipal Payment:

India’s largest banking and smart card manufacturer, Manipal Payment, submitted its DRHP to SEBI to raise ₹400 crore via fresh issue and an OFS of up to 1.75 crore shares. The company’s expected valuation is around ₹12,000 crore.

Upcoming IPO FAQs:

A: When a company decides to sell its shares to the public for the first time on the stock market, it’s called an Initial Public Offering.

A: An upcoming IPO means a company is planning to go public by filing a DRHP with SEBI. Once it gets approval from SEBI, the company will then launch its IPO, which will be open for subscription for 3 days.

A: Some major companies like Reliance Jio, the National Stock Exchange (NSE), Flipkart, PhonePe, OYO, and SBI Mutual Fund are expected to hit the IPO market in 2026.

A: One can easily find the list of the upcoming IPO in 2026 on our reputable website IPO Watch. Here we update our investors with all the details related to IPOs, like the upcoming IPO list, allotment, listing, Live IPO GMP, subscription status, IPO review, and many more.

9 Responses

Great insights on the upcoming IPOs for 2026! I’m particularly excited to see how these companies will perform in the market. Keep up the good work with the updates!

This IPO calendar is really helpful for keeping track of upcoming opportunities in 2026! I’m particularly excited about the potential of the tech companies listed. Looking forward to more updates as we get closer to their launch dates!

Good information thak u…

This page is good for beginners to check upcoming ipos with the proper details.

It will be help if you could advise whether apply for a ipo or avoid it

Good analysis

This page is good for beginners to check upcoming ipos with the proper details.

This is informative page.

When the NSE IPO is upcoming? please update