The promoters of the Company are Muthoot Finance Limited, Sarvam Financial Inclusion Trust and DR. Kalpanaa Sankar. The registrar of the IPO is Link Intime India Private Limited The book-running lead managers of the Belstar Microfinance IPO are ICICI Securities Limited, Axis Capital Limited, SBI Capital Markets Limited, and HDFC Bank Limited.

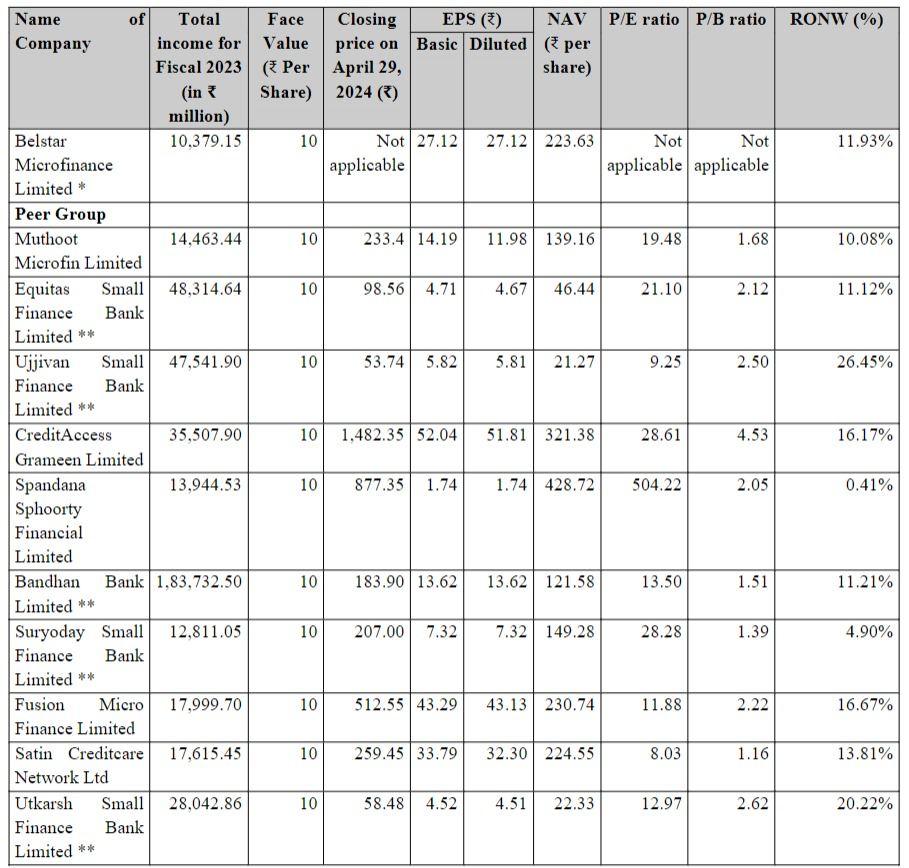

The company reported revenue of ₹10,379.15 million in 2023 against revenues of ₹7,284.31 million in 2022. The PAT was 1,303.25 million in 2023 against the PAT of 451.29 million in 2022. The peer group of companies are Muthoot MicrofinLimited, Equitas Small Finance Bank Limited, Ujjivan Small Finance Bank Limited, CreditAccess Grameen Limited, Spandana Sphoorty Financial Limited, Bandhan Bank Limited, Suryoday Small Finance Bank Limited, Fusion Micro Finance Limited, Satin Creditcare Network Ltd, and Utkarsh Small Finance Bank Limited.

Belstar Microfinance Limited was established in 1988 and provides a diverse range of loan products including those for micro-enterprises, small enterprises, consumer goods, festivals, education, and emergencies. As of December 31, 2023, it ranks as the 9th largest Non-Banking Finance Company—Micro Finance Institution (NBFC-MFI) in India based on its assets under management (AUM).

The company operates in 279 districts across 19 states and union territories in India, with 1,009 branches and 10,169 employees. It serves approximately 2.67 million customers as of December 31, 2023.