The promoters of the Company are Kishore Rajaram Chhabria, Bina Kishore Chhabria, Resham Chhabria Jeetendra Hemdev, Bina Chhabria Enterprises Private Limited, BKC Enterprises Private Limited, Oriental Radios Private Limited, and Officer’s Choice Spirits Private Limited. The registrar of the IPO is Link Intime India Private Limited. The book-running lead managers of the Allied Blenders IPO are ICICI Securities Limited, Nuvama Wealth Management Limited, and ITI Capital Limited.

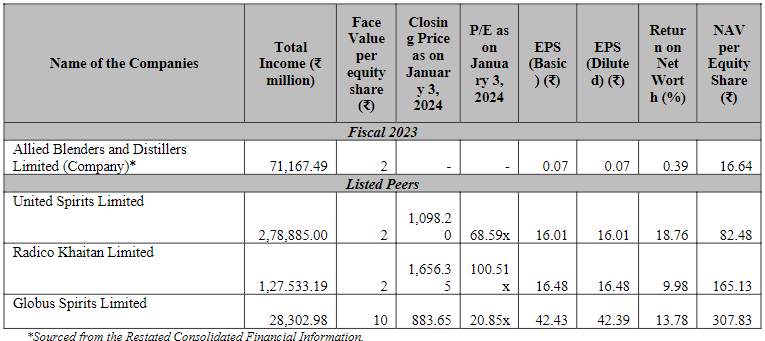

The company reported revenue of ₹71,167.49 million in 2023 against revenues of ₹72,081.65 million in 2022. The PAT was 16.01 million in 2023 against 14.76 million in 2022. The peer groups of the company are United Spirits Limited, Radico Khaitan Limited, and Globus Spirits Limited.

Allied Blenders is the largest Indian-owned Indian-made foreign liquor (“IMFL”) company and the third largest IMFL company in India, in terms of annual sales volumes between Fiscal 2014 and Fiscal 2022. (Source: Technopak Report). They are one of the only four spirits companies in India with a pan-India sales and distribution footprint, a leading exporter of IMFL, and had an estimated market share (in terms of sales volume) of 11.8% in the Indian whisky market for Fiscal 2023.

Their flagship brand, Officer’s Choice Whisky was launched in 1988 with their entry into the mass premium whisky segment. Officer’s Choice Whisky has been among the top-selling whisky brands globally in terms of annual sales volumes between 2016 and 2019. (Source: Technopak Report). Over the years, they have expanded and introduced products across various categories and segments. As of August 31, 2023, their product portfolio comprised 17 major brands of IMFL across whisky, brandy, rum, and vodka. Certain of our brands, such as Officer’s Choice Whisky, Sterling Reserve, Officer’s Choice Blue, and ICONiQ Whisky, are ‘Millionaire Brands’ or brands that have sold over a million 9-litre cases in one year. (Source: Technopak Report)