Enfuse Solutions is engaged in the business of providing integrated Digital solutions across various domains including (i) In Data Management & Analytics (ii) E-commerce & Digital Services (iii) Machine Learning & Artificial intelligence (iv) Edtech & Technology Solutions. They provide these service solutions by combining custom-designed data processes, delivery teams that include both generalists and domain specialists and their in-house software to streamline and automate various processes.

Their business operations encompass various domains (i) In Data Management & Analytics, they organize and analyze data, providing tailored insights for informed decision-making such as Master data Management, Product Information Management, etc (ii) E-commerce & Digital Services form a core area where they develop and optimize digital platforms for seamless online experiences such as E-commerce platform management, content management, Digital marketing, etc (iii) Machine Learning & AI represent their capabilities in advanced technologies, offering innovative solutions such as tagging/labeling, Transcription, Annotation, etc (iv) Edtech & Technology Solutions focus on leveraging technology to enhance educational experiences and overall technological solutions such as live Proctoring, Record and review, Student Counselling, etc.

Through their clients, they have served entrepreneurs ranging from start-up enterprises to established companies, primarily consisting of blue-chip companies operating in sectors such as Technology, BFSI (Banking, Financial Services, and Insurance), Retail, Financial Services (FinTech), Media and Entertainment, Health, Education and various other industries. Recently, they received a work order for a System Integrator for the Computerization of PACS from the Commissioner for Co-operation & Registrar of Co-operative Societies, Maharashtra, for providing services like Operationalization of the software, Data digitization and migration, UAT and System Test, Setting up of support centers, Compliance reports etc of Rs. 64.53 Crs.

Objects of the Issue:

- Repayment of certain Borrowings availed by the Company.

- To meet Working Capital requirements.

- General Corporate Purpose

Enfuse Solutions IPO Review

- May Apply

Enfuse Solutions IPO Date & Price Band Details

| IPO Open: | March 15, 2024 |

| IPO Close: | March 19, 2024 |

| IPO Size: | Approx ₹22.44 Crores, 2,337,600 Equity Shares |

| Face Value: | ₹10 Per Equity Share |

| IPO Price Band: | ₹91 to ₹96 Per Equity Share |

| IPO Listing on: | NSE SME |

| Retail Quota: | 35% of the net offer |

| QIB Quota: | 50% of the net offer |

| NII Quota: | 15% of the net offer |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

| Anchor Investors in IPO: | Click Here |

Enfuse Solutions IPO Market Lot

The Enfuse Solutions IPO minimum market lot is 1200 shares with a ₹115,200 application amount.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 1200 | ₹115,200 |

| Retail Maximum | 1 | 1200 | ₹115,200 |

| S-HNI Minimum | 2 | 2400 | ₹230,400 |

Enfuse Solutions IPO Dates

The Enfuse Solutions IPO date is March 15 and the IPO close date is March 19. The IPO allotment date is March 20 and the IPO might list on March 22.

| IPO Open Date: | March 15, 2024 |

| IPO Close Date: | March 19, 2024 |

| Basis of Allotment: | March 20, 2024 |

| Refunds: | March 21, 2024 |

| Credit to Demat Account: | March 21, 2024 |

| IPO Listing Date: | March 22, 2024 |

You can check IPO subscription status and IPO allotment status on their respective pages.

Enfuse Solutions IPO Form

How to apply Enfuse Solutions IPO? You can apply Enfuse Solutions IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Enfuse Solutions IPO in the Invest section. The other option you can apply Enfuse Solutions IPO via IPO forms download via the NSE website. Check out the Enfuse Solutions forms – click NSE IPO Forms download, fill and submit in your bank or with your broker.

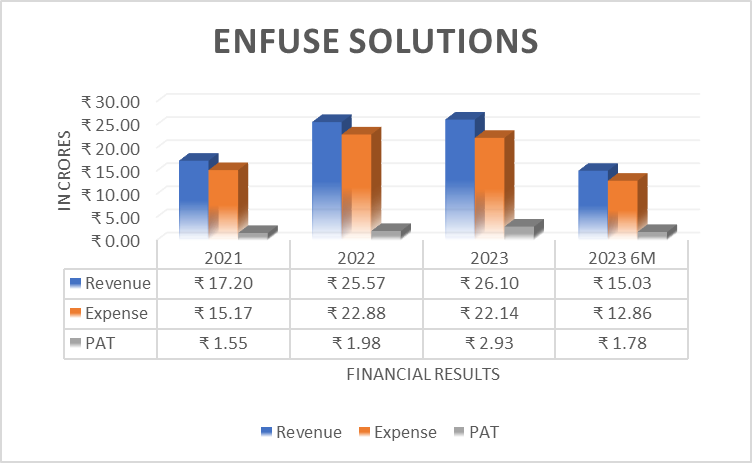

Enfuse Solutions Company Financial Report

| ₹ in Crores | |||

| Year | Revenue | Expense | PAT |

| 2021 | ₹17.20 | ₹15.17 | ₹1.55 |

| 2022 | ₹25.57 | ₹22.88 | ₹1.98 |

| 2023 | ₹26.10 | ₹22.14 | ₹2.93 |

| 2023 6M | ₹15.03 | ₹12.86 | ₹1.78 |

Enfuse Solutions IPO Valuation – FY2023

Check Enfuse Solutions IPO valuations detail like Earning Per Share (EPS), Price/Earning P/E Ratio, Return on Net Worth (RoNW), and Net Asset Value (NAV) details.

| Earning Per Share (EPS): | ₹4.50 per Equity Share |

| Price/Earning P/E Ratio: | NA |

| Return on Net Worth (RoNW): | 45.21% |

| Net Asset Value (NAV): | ₹9.95 per Equity Share |

Peer Group

- Vertexplus Technologies Limited

- eClerx Services Limited

- Systango Technologies Limited

Company Promoters

- Imran Yasin Ansari

- Mohammedk Lalmohammed Shaikh

- Rahul Mahendra Gandhi

- Zaynulabedin Mohmadbhai Mira

Enfuse Solutions IPO Registrar

Bigshare Services Pvt Ltd

Phone: +91-22-6263 8200

Email: [email protected]

Website: http://www.bigshareonline.com

Enfuse Solutions IPO Allotment Status

Check Enfuse Solutions IPO allotment status on Bigshare website URL. Click Here

Enfuse Solutions IPO Lead Managers aka Merchant Bankers

- Hem Securities Limited

Company Address

Enfuse Solutions Limited

A/1503, Bonaventure Building

No.5, Rangnath Kesar Road, Dahisar West

Mumbai 400068

Phone: +91-22-28118383

Email: [email protected]

Website: https://www.enfuse-solutions.com/