This IPO contains fresh issues and an offer-for-sale. In a fresh issue, it contains shares of Rs 350 crore, while in an offer-for-sale, it contains shares of Rs 1.26 crore, as per DRHP. Its face value is Rs. 2 per share.

Nishant Jairath, Sachin Bembi, Navneet Jairath, and Bikramjit Bembi are promoters while Navita Jairath, Savita Bembi, Nisha Jairath, and Sonia Bembi Seth are promoter groups selling shareholders in OFS. The book-running lead managers for the IPO are Motilal Oswal Investment Advisors Limited, ICICI Securities Limited, and Axis Capital Limited.

The company is planning to use the net proceeds from the IPO for general corporate purposes, partial repayment of debt, and capital expenditures at its Pithampur unit.

The company was founded in 1986. It is a one-stop shop for sheet metal & tubular fabrication, component assembly for OEMs, and metal finishing in both the automotive and non-automotive industries. It specializes in manufacturing metal components for two-wheelers (including EVs and ICE), three-wheelers, passenger vehicles, agri-vehicles, commercial vehicles, and off-highway vehicles.

In FY 2024, Hero, Bajaj, Honda, and TVS, India’s top four two-wheeler OEMs, accounted for more than 80% of total sales, with Bajaj also leading in three-wheeler production. The company supplied products to all of these top 2W OEMs and Bajaj, India’s largest 3W OEM.

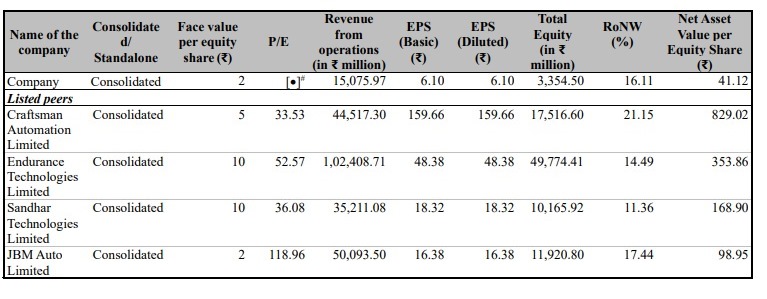

The company recorded revenue of Rs 1,508 crore in fiscal year 24 as opposed to Rs 1,051 crore in the previous year. Compared to Rs 117.84 crore the previous year, EBITDA for the fiscal year was Rs 131.72 crore. During the period, net profit was Rs 50 crore, down from Rs 63.11 crore the previous year.

As Metalman Auto Ltd. prepares for its upcoming IPO, the company plans to improve its financial position and expand its manufacturing capabilities, creating the foundation for future growth and industry leadership.